Accelleron Industries AG: A Financial Powerhouse in the Industrials Sector

In a remarkable display of financial prowess, Accelleron Industries AG, a Swiss titan in the development and production of turbochargers, has once again proven its mettle in the industrials sector. Listed on the SIX Swiss Exchange, the company has seen its stock price soar, closing at 57.3 CHF on July 13, 2025, just shy of its 52-week high of 57.35 CHF. This performance is a testament to the company’s robust market position and its strategic initiatives that have captivated investors and industry watchers alike.

A Year of Stellar Growth

Reflecting on the past year, Accelleron Industries AG’s stock has been a beacon of growth. A year ago, shares were valued at 38.48 CHF, marking a significant appreciation in value. This upward trajectory is not just a number; it’s a narrative of strategic foresight, innovation, and an unyielding commitment to reducing fuel consumption and emissions across various industries, including marine, power, oil and gas, and rail.

Ushering in a New Era of Financial Projections

In a bold move that underscores its confidence in the future, Accelleron Industries AG has announced a significant increase in its revenue forecast for 2025. This decision comes on the heels of an impressive growth spurt in the first half of the year, with the company reporting a 20% increase in revenue to 608 million USD, adjusted for constant exchange rates. This announcement has sent ripples through the financial markets, with Accelleron’s stock experiencing a notable surge.

The Market’s Response

The broader European markets have shown a positive response to Accelleron’s announcement, with indices like the DAX and Euro-Stoxx-50 witnessing modest gains. This optimism is further buoyed by positive eurozone data, which has helped European shares shrug off concerns over potential US tariffs on the European Union. In Zurich, the SPI index has also seen an uptick, reflecting a broader market confidence in Accelleron’s growth trajectory and its implications for the industrials sector.

A Testament to Strategic Innovation

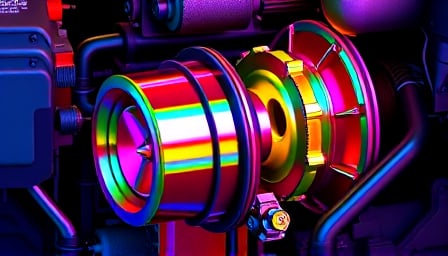

Accelleron Industries AG’s success story is not just about numbers; it’s a testament to the company’s strategic innovation and its commitment to advancing turbocharging technologies. By focusing on optimization solutions that reduce fuel and emissions, Accelleron is not just contributing to the bottom line; it’s playing a pivotal role in driving sustainable practices across industries worldwide.

Looking Ahead

As Accelleron Industries AG continues to navigate the complexities of the global market, its recent financial achievements and strategic decisions paint a promising picture for the future. With a market capitalization of 5.97 billion CHF and a price-to-earnings ratio of 39.28, the company is well-positioned to capitalize on its growth momentum. Investors and industry observers alike will be watching closely as Accelleron charts its course in the coming years, setting new benchmarks for innovation and financial performance in the industrials sector.