Ador Welding Ltd: A Deep Dive into Recent Financial Performance

Ador Welding Limited, a prominent player in the metalworking machinery sector, has recently come under the spotlight following the release of its latest financials on January 27th. The company, listed on the National Stock Exchange of India, has seen its stock price close at 965.35 Indian Rupees (INR) as of May 14th, 2025. This figure is part of a broader narrative that includes a 52-week high of INR 1489 on July 10th, 2024, and a 52-week low of INR 788 on April 6th, 2025. These fluctuations underscore the dynamic nature of the market and the challenges faced by Ador Welding in maintaining its financial stability.

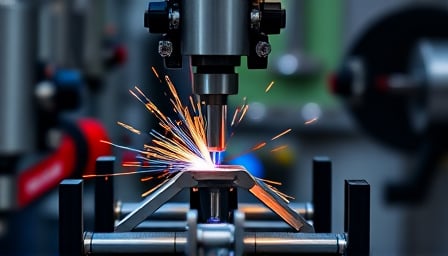

With a market capitalization of 14,933,359,417 INR, Ador Welding continues to be a significant entity in the industry. The company’s diverse product range, which includes welding electrodes, wires, fluxes, brazing rods, and welding and cutting equipment, caters to a global customer base. This extensive portfolio underscores Ador Welding’s commitment to innovation and quality, positioning it as a leader in the metalworking machinery market.

However, the recent financial disclosures have prompted investors to scrutinize the company’s financial health more closely. The price-to-earnings ratio of 24.4668 and a price-to-book ratio of 2.89772 are critical metrics that investors are analyzing to gauge the company’s valuation and growth prospects. These ratios, while indicative of the company’s current market position, also highlight the need for strategic initiatives to enhance shareholder value.

As Ador Welding navigates through these financial evaluations, the company’s leadership is expected to focus on optimizing operational efficiencies and exploring new market opportunities. The global reach of Ador Welding’s products provides a solid foundation for expansion, but it also necessitates a keen understanding of regional market dynamics and customer needs.

Looking ahead, Ador Welding’s ability to adapt to market changes and leverage its technological expertise will be crucial in sustaining its growth trajectory. Investors and industry analysts will be closely monitoring the company’s strategic moves, particularly in terms of product innovation and market expansion, to determine its long-term viability in the competitive landscape of metalworking machinery.

In conclusion, while Ador Welding faces challenges in the short term, its robust product offerings and global presence position it well for future growth. The company’s response to the current financial scrutiny will be pivotal in shaping its path forward, with a focus on enhancing operational efficiencies and capitalizing on emerging market opportunities.