Aehr Test Systems, a U.S.-based company specializing in the development, manufacturing, and sale of systems designed to reduce the cost of testing dynamic random access memory (DRAM) and other memory devices, recently reported its quarterly results. The company, headquartered in Fremont, operates within the Information Technology sector, specifically focusing on Semiconductors & Semiconductor Equipment. Aehr Test Systems is publicly traded on the Nasdaq stock exchange, with its initial public offering having taken place on August 14, 1997.

In its latest quarterly report released on January 10, 2026, Aehr Test Systems disclosed its financial performance, which reflects the company’s ongoing challenges and market volatility. The stock closed at $28.04 per share in the most recent trading session, marking a notable increase from the close price of $26.78 on January 25, 2026. Over the past year, the stock has experienced significant fluctuations, reaching a 52-week high of $34.35 on October 1, 2025, and a 52-week low of $6.27 on April 3, 2025. This volatility underscores the dynamic nature of the semiconductor industry and the specific challenges faced by Aehr Test Systems.

Financial metrics reveal a negative price-to-earnings (P/E) ratio of -93.26, indicating that the company has either incurred losses or has extremely low earnings. This negative P/E ratio is a critical indicator of the financial difficulties Aehr Test Systems is encountering, as it suggests that the company is not currently generating profits. Additionally, the price-to-book (P/B) ratio stands at 6.75, suggesting that the market values the firm at approximately 6.75 times its book value. This valuation metric provides insight into investor sentiment and the perceived potential for future growth or recovery.

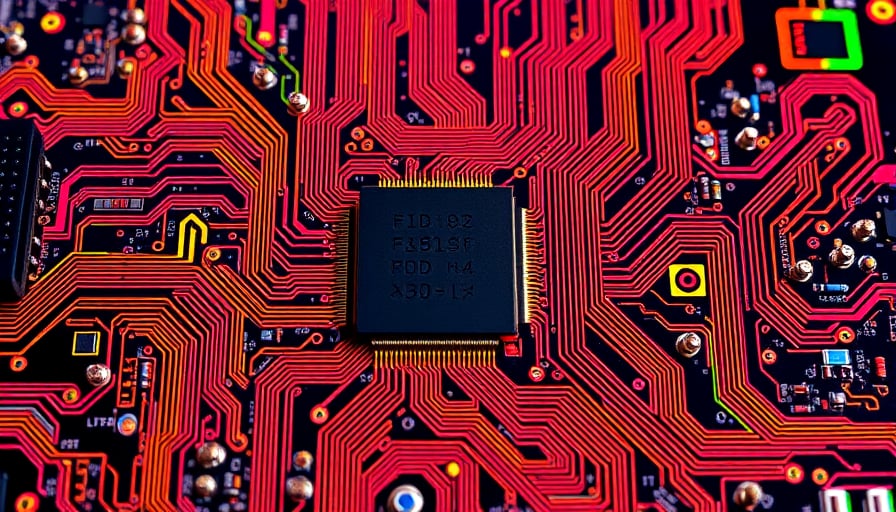

With a market capitalization of $820,200,256 USD, Aehr Test Systems continues to play a significant role in the semiconductor testing industry. The company’s systems are integral for integrated circuit manufacturers, enabling them to perform test and burn-in of bare dies and screen complex logic and memory devices. Despite the financial challenges reflected in its valuation metrics, Aehr Test Systems remains committed to its mission of reducing testing costs and enhancing the efficiency of memory device production.

For more detailed information about Aehr Test Systems, stakeholders and interested parties are encouraged to visit the company’s official website at www.aehr.com . The company’s ongoing efforts to navigate the complexities of the semiconductor market and its strategic initiatives will be closely watched by investors and industry analysts alike.