Ambarella Inc. Stock Surges on Strong Q2 Results and Guidance Increase

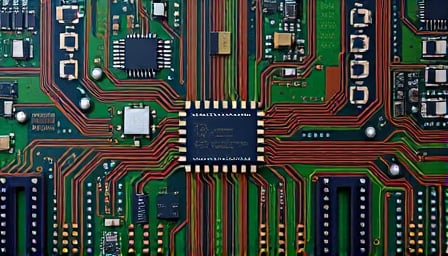

Ambarella, Inc. (Nasdaq: AMBA), a Santa Clara-based information technology company specializing in high-definition video compression and image processing semiconductors, experienced a significant stock surge on August 29, 2025. The company’s shares rose by 20% following the release of its Fiscal Q2 2026 earnings results, which exceeded Wall Street expectations.

Strong Earnings Performance

Ambarella reported an adjusted earnings per share (EPS) of 15 cents for the quarter, tripling the analysts’ estimate of 5 cents. This marked a substantial improvement from the adjusted EPS of -13 cents reported in the same period the previous year. The company’s strong performance was driven by robust demand for its semiconductors, which are used in digital still cameras, camcorders, and video-enabled mobile phones.

Positive Guidance and Market Reaction

In addition to the impressive earnings, Ambarella provided an increased guidance for the upcoming quarters, further boosting investor confidence. The company’s market capitalization stood at approximately $2.995 billion as of August 27, 2025, with a close price of $70.63. The stock’s 52-week high was $85.15, reached on January 20, 2025, while the 52-week low was $38.86, recorded on April 6, 2025.

Broader Market Context

Despite Ambarella’s positive news, the broader market experienced some volatility. On the same day, US stock indices showed a slight decline as investors took profits following recent record highs. The market was also influenced by the upcoming long weekend, with the US stock market closed on Monday for the Labor Day holiday.

Analyst Expectations

Prior to the earnings release, 12 analysts had projected an average EPS of $0.054 for the quarter, compared to a loss of $0.850 in the same quarter of the previous year. Revenue expectations were also optimistic, with 11 analysts forecasting a 41.24% increase to $90.0 million, up from the previous year’s figures.

Ambarella’s strong performance and positive outlook have positioned it favorably within the semiconductor industry, highlighting its resilience and growth potential in a competitive market.