American Eagle Gold Corp: A Precarious Flight in the Gold Sector

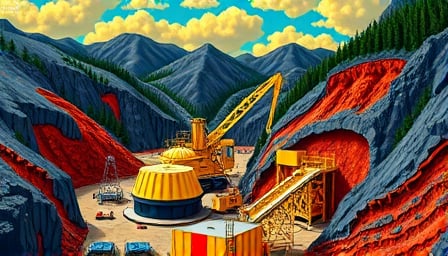

In the volatile world of gold exploration and mining, American Eagle Gold Corp stands as a testament to both ambition and the harsh realities of the materials sector. Based in Toronto, Canada, this company has carved out a niche in the global market, offering exploration and mining services with a focus on gold projects. However, recent financial indicators suggest a turbulent journey ahead.

As of July 29, 2025, American Eagle Gold Corp’s close price stood at a mere 0.465 CAD, a stark contrast to its 52-week high of 1.07 CAD on November 24, 2024. This significant drop highlights the challenges the company faces in maintaining investor confidence and market stability. The 52-week low, recorded at 0.38 CAD on September 5, 2024, further underscores the volatility and uncertainty surrounding the company’s financial health.

With a market capitalization of 80,387,943 CAD, American Eagle Gold Corp’s valuation reflects the broader struggles within the gold sector. The company’s listing on the TSX Venture Exchange, a platform known for hosting emerging and high-risk ventures, suggests a need for strategic recalibration to navigate the competitive landscape effectively.

Exploration and Development: A Double-Edged Sword

American Eagle Gold Corp’s specialization in exploring and developing gold projects is both its strength and its Achilles’ heel. While the company serves customers globally, the inherent risks of exploration—such as fluctuating gold prices, regulatory hurdles, and operational challenges—pose significant threats to its stability and growth prospects.

The company’s website, www.americaneaglegold.ca , serves as a digital gateway to its operations and ambitions. However, the online presence alone cannot mitigate the tangible risks associated with gold exploration. Investors and stakeholders must critically assess whether American Eagle Gold Corp can leverage its expertise to overcome these challenges and achieve sustainable growth.

A Call for Strategic Reassessment

In light of the current financial indicators and market conditions, American Eagle Gold Corp faces a critical juncture. The company must undertake a strategic reassessment to address its vulnerabilities and capitalize on potential opportunities within the gold sector. This may involve diversifying its project portfolio, enhancing operational efficiencies, and strengthening its financial position to weather market fluctuations.

As the company navigates this precarious landscape, the question remains: Can American Eagle Gold Corp soar to new heights, or will it remain grounded by the weight of its challenges? Only time will tell, but one thing is certain—the stakes are high, and the path forward is fraught with uncertainty.