AMETEK Inc. Enhances Precision Parts Capabilities Through Strategic Acquisition

AMETEK Inc. (NYSE: AME), a leading global manufacturer of electronic instruments and electromechanical devices, has announced the completion of its acquisition of StenTech, a specialty provider of precision parts. The transaction, disclosed on October 18, 2025 by Business News This Week, is expected to reinforce AMETEK’s position in high‑performance components for aerospace, process control, and power generation markets.

Transaction Overview

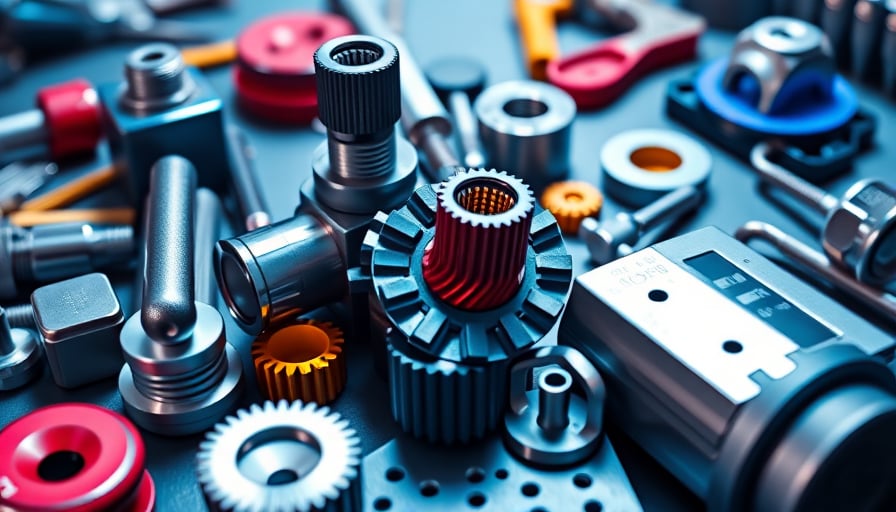

The deal represents a significant expansion of AMETEK’s precision manufacturing portfolio. StenTech’s product lines—encompassing high‑accuracy gears, bearings, and custom machining solutions—complement AMETEK’s existing capabilities in advanced instruments and specialty metals. By integrating StenTech’s engineering expertise, AMETEK will accelerate the development of next‑generation measurement and control systems, particularly those requiring sub‑millimeter tolerances.

Strategic Rationale

Broader Market Footprint

AMETEK’s current market segments include process instrumentation, aerospace, power, and industry-specific equipment. The acquisition adds a new revenue stream in the precision parts sector, which is projected to grow as industries such as automotive and electronics increasingly demand tighter tolerances and higher reliability.Technology Synergy

StenTech’s proprietary manufacturing processes—advanced laser machining, ultra‑precision grinding, and additive‑manufacturing techniques—align with AMETEK’s ongoing investment in digital twin and predictive maintenance platforms. The integration will enable co‑development of integrated sensor‑actuator assemblies, enhancing the value proposition for clients in the aerospace and power sectors.Geographic Expansion

StenTech’s manufacturing facilities in Europe and Asia provide AMETEK with expanded geographic coverage. This diversification mitigates supply‑chain risks and positions the company to serve emerging markets in Southeast Asia and Eastern Europe more effectively.

Financial Impact

While AMETEK has not yet disclosed the transaction value, analysts anticipate a modest impact on earnings per share, given the alignment of StenTech’s cost structure with AMETEK’s existing operations. The company’s 2025–2026 guidance, which projects a 12% revenue growth and a 4% margin expansion, should absorb the integration costs without compromising long‑term profitability. At the close on October 16, 2025, AMETEK’s share price stood at $185.47, with a market capitalization of approximately $42.8 billion and a price‑earnings ratio of 29.86.

Forward‑Looking Outlook

The precision parts market is expected to expand at a compound annual growth rate of 8.85% from 2026 to 2032, as highlighted by Verified Market Research in its Laser Interferometer market analysis. This broader trend underscores the strategic fit of the StenTech acquisition, positioning AMETEK to capture a larger share of high‑margin precision component sales.

Furthermore, the integration will strengthen AMETEK’s competitive edge against peers such as Emerson and Honeywell, who are also investing in precision manufacturing capabilities. By combining its advanced instrumentation with StenTech’s machining precision, AMETEK is poised to deliver comprehensive solutions that meet the escalating demands for reliability and accuracy in aerospace, power generation, and industrial automation.

Conclusion

The acquisition of StenTech marks a decisive step for AMETEK Inc. to deepen its precision manufacturing footprint and enhance its technology platform. With a clear strategic rationale and alignment to projected market growth, the transaction is likely to drive value creation for shareholders, reinforce operational synergies, and secure AMETEK’s leadership in the evolving landscape of high‑precision industrial equipment.