ANDRITZ AG: Recent Business Developments and Market Context

Strategic Partnerships and Contracts

Sustainable Fibre Initiative

ANDRITZ AG announced a collaboration with Tandem Repeat to develop next‑generation sustainable fibre technologies. The partnership aims to integrate ANDRITZ’s machinery and process expertise with Tandem Repeat’s advanced fibre production systems, targeting reductions in energy consumption and raw‑material usage in the textile sector.Hydropower Modernisation – Srinagarind Project

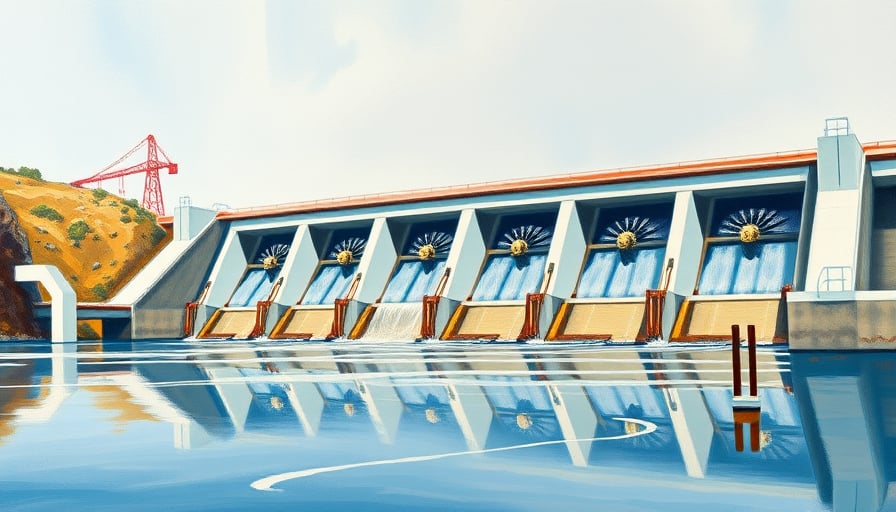

The Electricity Generating Authority of Thailand (EGAT) has commissioned ANDRITZ to upgrade two pumped‑storage turbine‑generator sets at the Srinagarind hydroelectric plant. The contract, valued in the middle two‑digit millions of euros, covers refurbishment, performance optimisation, and integration of modern control systems. ANDRITZ will also deliver four rotary phase shifters for Statkraft projects in Ireland and Northern Ireland, enhancing grid stability and power quality in those regions.BASF Licensing Agreement

ANDRITZ entered into a license agreement with BASF, granting the German chemical group rights to certain ANDRITZ‑developed technologies. The deal focuses on process automation and energy efficiency solutions applicable to BASF’s manufacturing operations.

Market Performance

Stock Activity

On 27 October, ANDRITZ shares traded at €63.10, reflecting a modest increase from the previous close. The stock is situated at €63.10 against a 52‑week high of €67.85 and a low of €47.18. The market capitalization stands at €6.11 billion, with a price‑earnings ratio of 13.35, indicating a valuation within the industry average for industrial machinery suppliers.ATX Index Influence

The Vienna Stock Exchange’s ATX index recorded a 0.21 % rise at 12:07 UTC on 29 October, reaching 4,692.14 points. This broader market movement provided a supportive backdrop for ANDRITZ’s trading day.

Implications for Investors

The recent contracts underscore ANDRITZ’s continued expansion in renewable energy infrastructure and advanced materials processing. The partnership with Tandem Repeat and the LNG‑free phase shifter deliveries to Statkraft reinforce the company’s positioning in high‑growth, technology‑intensive segments. The BASF licensing agreement further diversifies the revenue base and strengthens the company’s intellectual property portfolio.

Investors should monitor the execution of the Srinagarind modernization contract and the commercialisation of the sustainable fibre technology for potential future earnings impact. Additionally, the company’s market performance relative to the ATX index suggests a stable investment profile within the industrial sector.