Anhui Jiangnan Chemical Industry Co Ltd: Navigating Market Dynamics Amidst Sectoral Shifts

In the bustling world of financial markets, Anhui Jiangnan Chemical Industry Co Ltd, a prominent player in the chemicals sector, finds itself at the intersection of industry trends and market speculation. Listed on the Shenzhen Stock Exchange, the company has been a focal point for investors, especially with its recent performance and strategic positioning within the broader materials sector.

Recent Market Performance

As of July 21, 2025, Anhui Jiangnan Chemical Industry Co Ltd’s stock closed at 6.92 CNH, marking its 52-week high. This performance is particularly noteworthy against the backdrop of its 52-week low of 3.62 CNH on September 12, 2024. With a market capitalization of 14,830,000,000 CNH and a price-to-earnings ratio of 16.62, the company’s financial health and investor sentiment appear robust.

Sectoral Trends and Company Positioning

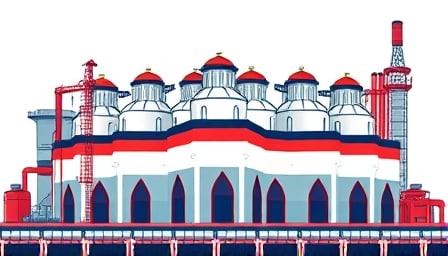

The company specializes in the production of explosive devices for civil uses, with industrial dynamites being its main product. This niche positioning within the chemicals industry places Anhui Jiangnan Chemical Industry Co Ltd in a unique spot, especially as the sector experiences shifts due to policy changes and market dynamics.

Recent news highlights a significant trend within the traditional infrastructure sector, often referred to as the “anti-internalization” movement, which could lead to valuation corrections. This movement has seen major infrastructure companies, including those in the explosives and construction materials sectors, gaining attention from investors. Specifically, the “Yalu Zangbu River Lower Reclamation Project” has sparked interest, with companies related to this project experiencing stock price surges.

Investor Sentiment and Future Outlook

Amidst these developments, Anhui Jiangnan Chemical Industry Co Ltd has seen its stock price influenced by broader sectoral trends. The company’s association with the explosives sector, particularly in the context of infrastructure projects, has led to increased investor interest. However, the company has issued clarifications regarding its involvement in specific projects, highlighting the uncertainties surrounding its participation in the Yalu Zangbu River Lower Reclamation Project.

Despite these uncertainties, the company’s stock has experienced volatility, with significant trading volumes and price movements. This volatility reflects the market’s sensitivity to news and developments within the sector, as well as the company’s strategic decisions.

Conclusion

Anhui Jiangnan Chemical Industry Co Ltd stands at a critical juncture, with its future performance closely tied to sectoral trends, policy changes, and its strategic positioning within the explosives and chemicals industry. As the company navigates these dynamics, investors and market watchers will be keenly observing its moves, especially in relation to major infrastructure projects and its ability to capitalize on sectoral shifts. With a solid financial foundation and a niche market position, Anhui Jiangnan Chemical Industry Co Ltd is poised to play a significant role in the evolving landscape of the materials sector.