Anhui Quanchai Engine Co Ltd: Financial Highlights and Market Activity

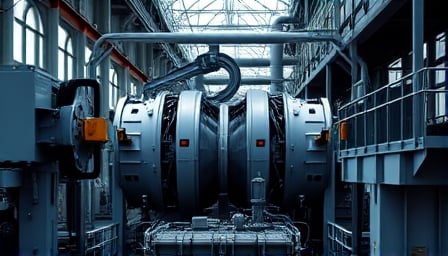

Anhui Quanchai Engine Co Ltd, a prominent player in the industrial sector, specializes in manufacturing diesel internal combustion engines for tractors, farm vehicles, and other applications. The company is listed on the Shanghai Stock Exchange and has a market capitalization of 3.94 billion CNH. As of August 17, 2025, the company’s close price was 9.05 CNH, with a 52-week high of 10.58 CNH on March 12, 2025, and a 52-week low of 6.16 CNH on August 22, 2024. The price-to-earnings ratio stands at 44.731.

Market Performance and Sector Trends

On August 19, 2025, the industrial sector, particularly the new industrialization board, led the market with a 2.97% increase. Anhui Quanchai Engine Co Ltd, also known as 全柴动力 (600218), saw a significant rise of 10.06%. This surge was part of a broader trend where companies like 华胜天成 and 剑桥科技 also experienced notable gains, with increases of 10.01% and 9.99%, respectively.

Company-Specific Developments

Anhui Quanchai Engine Co Ltd reached its price limit on August 19, marking its second such occurrence in the past year. The company’s recent performance can be attributed to several factors:

Product Portfolio and Market Position: The company’s primary products include internal combustion engines and related components, covering power ranges from 20 to 300 horsepower. These products are utilized in various sectors, including automotive, industrial vehicles, construction machinery, and agricultural equipment. The company has established strategic partnerships with several leading domestic enterprises.

Ownership and Control: As of a 2025 announcement, Anhui Quanchai Engine Co Ltd remains a state-owned enterprise, with the ultimate controlling entity being the Quanjiao County Government. The controlling equity was transferred without charge to Quanjiao Huike Industrial Investment Group, maintaining the status quo in terms of actual control.

Financial Performance: In the first quarter of 2025, the company reported a revenue of 12.93 billion CNH, marking a 5.78% increase year-over-year. The attributable net profit rose by 17.65% to 2.98379 million CNH.

Investment Activity

On August 18, 2025, Anhui Quanchai Engine Co Ltd received significant investment activity, with 1.50885 million CNH in financing purchases, accounting for 41.39% of the day’s total purchase amount. The current financing balance stands at 3.39 billion CNH, representing 8.60% of the company’s circulating market value, which is below the historical 20% percentile.

In terms of margin trading, the company saw a margin repayment of 0 shares and a margin sale of 100 shares on August 18, 2025. The total margin balance is 714,045 CNH, exceeding the historical 60% percentile.

Conclusion

Anhui Quanchai Engine Co Ltd’s recent market performance and financial activities indicate strong investor interest and a positive outlook for the company. The industrial sector’s momentum, coupled with the company’s strategic positioning and robust financial results, suggests potential for continued growth. Investors and market analysts will likely keep a close watch on the company’s future developments and market trends.