Anji Microelectronics Technology Shanghai Co Ltd: A Strategic Overview

In the dynamic landscape of the semiconductor industry, Anji Microelectronics Technology Shanghai Co Ltd stands out as a pivotal player. As a publicly traded entity on the Shanghai Stock Exchange, the company has demonstrated resilience and strategic foresight, navigating the complexities of the global tech market with agility.

Financial Performance and Market Position

As of July 28, 2025, Anji Microelectronics closed at 154.94 CNY, reflecting a robust performance in a volatile market. The company’s stock has seen significant fluctuations over the past year, with a 52-week high of 161 CNY on July 3, 2025, and a low of 74.0615 CNY on August 22, 2024. This volatility underscores the challenges and opportunities within the semiconductor sector, where demand and innovation cycles drive market dynamics.

With a market capitalization of approximately 26.46 billion CNY, Anji Microelectronics holds a substantial position in the industry. The company’s price-to-earnings ratio of 44.7921 indicates investor confidence in its growth potential, despite the high valuation reflecting the competitive nature of the market.

Strategic Initiatives and Future Outlook

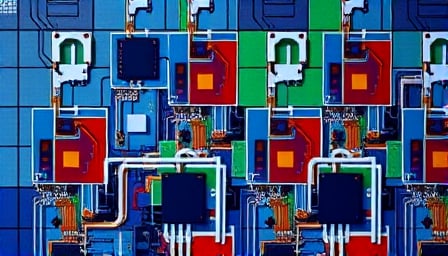

Anji Microelectronics has been at the forefront of technological advancements, focusing on the development of cutting-edge semiconductor solutions. The company’s strategic initiatives are geared towards enhancing its product portfolio and expanding its global footprint. By investing in research and development, Anji Microelectronics aims to maintain its competitive edge and meet the evolving demands of the tech industry.

The company’s leadership is committed to leveraging its strengths in innovation and manufacturing to capitalize on emerging trends such as artificial intelligence, 5G, and the Internet of Things (IoT). These sectors present significant growth opportunities, and Anji Microelectronics is well-positioned to benefit from the increasing integration of advanced technologies across various industries.

Challenges and Opportunities

Despite its strong market position, Anji Microelectronics faces challenges typical of the semiconductor industry, including supply chain disruptions and geopolitical tensions. However, the company’s strategic partnerships and diversified operations provide a buffer against these uncertainties, allowing it to adapt and thrive in a rapidly changing environment.

Looking ahead, Anji Microelectronics is poised to capitalize on the global shift towards digital transformation. The company’s focus on innovation and strategic expansion will be crucial in navigating the competitive landscape and achieving sustained growth.

In conclusion, Anji Microelectronics Technology Shanghai Co Ltd remains a key player in the semiconductor industry, with a clear vision for the future. Its strategic initiatives and robust financial performance position it well to capitalize on the opportunities presented by the ongoing technological revolution.