Ares Strategic Mining Inc. Closes Initial Tranche of LIFE Offering and Reports Surge in Short Interest

Ares Strategic Mining Inc. (OTC: ARSMF) announced on 17 October 2025 that it had completed the first tranche of its LIFE (Liquidity Improvement and Funding Enhancement) offering. The company filed an amended and restated offering document with the Securities and Exchange Commission, detailing the terms and intended use of proceeds. The offering is part of a broader strategy to strengthen the balance sheet and fund exploration activities, particularly in lithium and fluorspar properties.

Key Details of the LIFE Offering

| Item | Information |

|---|---|

| Closing Date | 17 October 2025 |

| Offering Type | LIFE (Liquidity Improvement and Funding Enhancement) |

| Documentation | Amended and restated offering document filed with the SEC |

| Purpose | Enhance liquidity and support exploration and development of lithium and fluorspar assets |

The filing confirms that the first tranche has been successfully closed, although specific figures for the amount raised and pricing were not disclosed in the public statement. The company’s management emphasized that the proceeds will be allocated to working capital needs and ongoing exploration projects.

Short Interest Surge

In a separate development reported by American Banking News on 18 October 2025, Ares Strategic Mining experienced a dramatic increase in short interest during September. Key metrics are as follows:

- Short Interest (30 September): 142,100 shares

- Increase from 15 September: 28,320 % (from 500 shares)

- Average Daily Trading Volume: 642,000 shares

- Days‑to‑Cover Ratio: 0.2 days

The sharp rise in short positions indicates heightened speculation against the stock, potentially reflecting concerns about the company’s valuation or operational progress. At the same time, the company’s share price remained within a range defined by its 50‑day and 200‑day simple moving averages of $0.25 and $0.20, respectively.

Market Context

- Current Share Price (16 October 2025): CAD 0.475

- 52‑Week High: CAD 1.03 (as of 9 October 2025)

- 52‑Week Low: CAD 0.125 (as of 4 November 2024)

- Market Capitalization: CAD 100,488,574

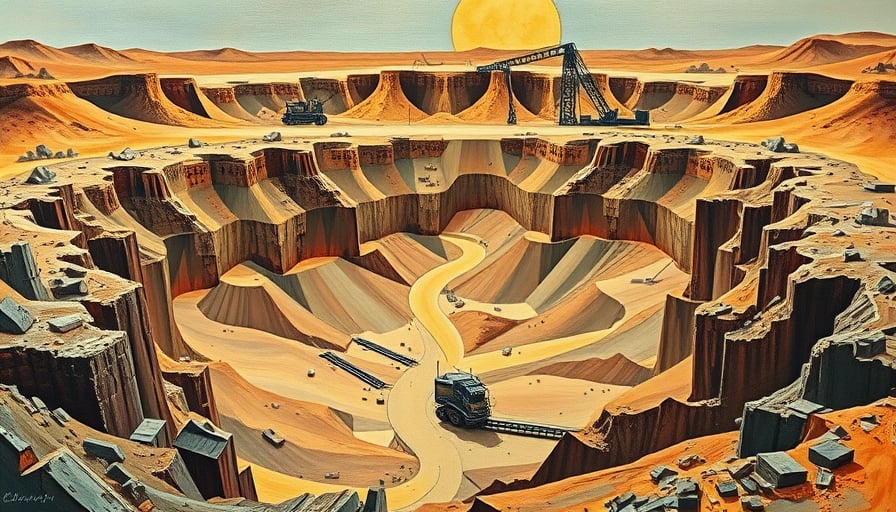

Ares Strategic Mining operates as a junior natural resource mining company focused on the acquisition, exploration, and development of lithium and fluorspar properties in Canada and the United States. The company holds full interest in the Lost Sheep Fluoride Mine in Utah (353 claims covering approximately 5,982 acres) and the Liard Fluorspar property.

Implications

The completion of the LIFE offering provides Ares Strategic Mining with additional liquidity that can be directed toward its exploration pipeline and potential production activities. However, the significant short interest may signal investor caution, which could influence short‑term trading volatility. Management’s focus on strengthening the balance sheet may mitigate some of these concerns, but market participants should monitor the company’s subsequent filings and operational updates for further insight.