ASML Holding NV: A Catalyst for the AI‑Driven Chip Revolution

The Dutch semiconductor equipment titan has once again positioned itself at the epicenter of the global technology race. On Thursday morning, the AEX index surged by 0.9 %, a lift that can be traced directly to ASML’s robust performance. The company’s stock opened at a 4.3 % gain, reinforcing its status as the largest contributor to the index’s climb.

Record‑Setting Order Book

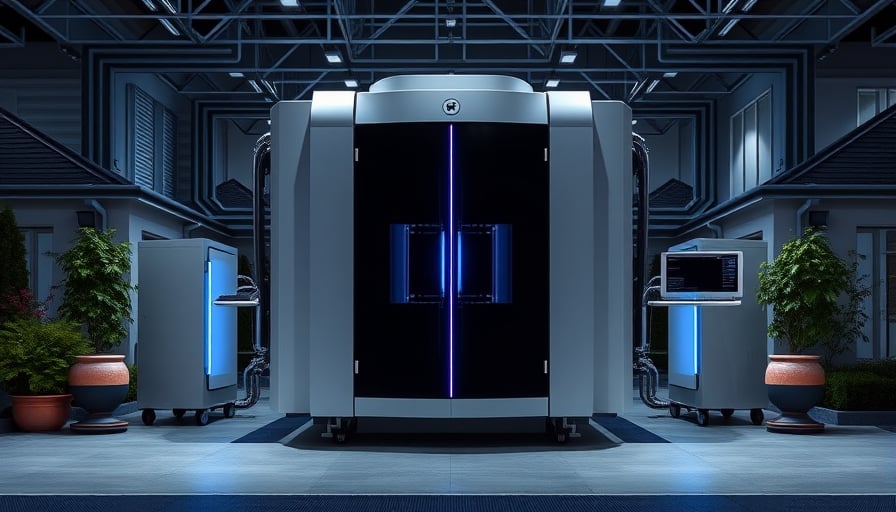

ASML’s latest quarterly report unveiled an unprecedented volume of new orders. Analysts point to this as the single most persuasive metric, underscoring the firm’s central role in meeting the insatiable demand for advanced lithography systems. The surge in AI‑driven workloads—particularly in deep‑learning inference and training—has amplified the need for cutting‑edge semiconductor manufacturing. ASML’s products, especially extreme‑ultraviolet (EUV) lithography tools, are indispensable for producing the smallest, most powerful chips that power AI accelerators.

Wall Street’s Overweight Upgrades

The surge in orders has not gone unnoticed by the investment community. Barclays, Berenberg, and Jefferies have all upgraded ASML’s rating to Overweight and raised their price targets to €1 500. The consensus is clear: the company’s revenue trajectory and margin profile remain resilient even as the semiconductor cycle fluctuates. Barclays, in particular, attributes the upward revision to the “AI demand surge,” while Berenberg’s research team highlights the firm’s “record orders” as evidence of sustained growth.

Market Reaction and Share Price

At the time of the Barclays upgrade, ASML traded at €1 210, up by 1.58 % on Tradegate. The stock’s closing price for the day was €1 194.40, a slight dip from the intraday peak but still comfortably above the 52‑week low of €508.40. The current price-to-earnings ratio of 47.96 reflects the premium investors are willing to pay for ASML’s strategic moat.

Corporate Governance and Workforce Management

Notwithstanding its market success, ASML faces internal challenges. A recent article in Computable.nl criticized the company’s handling of forced redundancies, labeling the practice as unacceptable. While ASML’s board has defended the restructuring as necessary for maintaining competitiveness, the backlash underscores a growing scrutiny over labor practices within high‑tech firms.

Strategic Implications

ASML’s dominance in lithography positions it as a gatekeeper for the entire semiconductor supply chain. Without Dutch chip equipment, the AI boom fueled by Nvidia and other GPU leaders would stall. This symbiotic relationship places ASML in a unique bargaining position, enabling it to command premium pricing while safeguarding its technology through robust intellectual property protections.

Outlook

With a market cap exceeding €457 billion and a trailblazing product portfolio, ASML is poised to capitalize on the next wave of AI‑driven semiconductor demand. The company’s ability to scale production, manage supply chain constraints, and navigate regulatory scrutiny will determine whether it maintains its market leadership or succumbs to intensified competition from rivals such as Samsung and TSMC’s own lithography initiatives.

In a world where every new algorithm depends on ever-smaller transistors, ASML holds the keys to the kingdom. Investors and industry observers alike should watch closely as the firm continues to translate technological breakthroughs into tangible financial performance.