Associated Banc-Corp: A Decade of Growth and Resilience

In the ever-evolving landscape of the financial sector, Associated Banc-Corp stands as a testament to resilience and strategic growth. As of August 26, 2025, the company’s shares closed at $26.94 on the New York Stock Exchange, reflecting a robust recovery from a 52-week low of $18.32 in April 2025. This rebound underscores the bank’s ability to navigate market fluctuations and capitalize on growth opportunities.

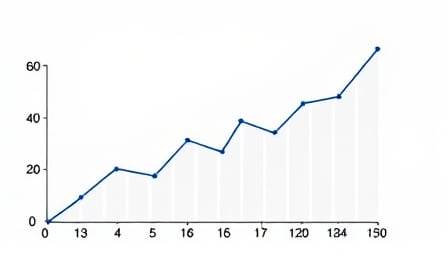

A decade ago, on August 26, 2015, Associated Banc-Corp’s shares were valued at $17.70. Fast forward to today, and the company’s market capitalization stands at $4.18 billion, with a price-to-earnings ratio of 33.754. This impressive growth trajectory highlights the bank’s strategic initiatives and its commitment to delivering value to shareholders.

Associated Banc-Corp, headquartered in Green Bay, Wisconsin, serves as a cornerstone of the Midwestern banking franchise. The institution offers a comprehensive suite of financial products and services across Wisconsin, Illinois, and Minnesota, while extending its commercial financial services to Indiana, Michigan, Missouri, Ohio, and Texas. This expansive reach positions the bank as a key player in the regional banking sector.

Looking ahead, Associated Banc-Corp is poised to continue its growth trajectory. The bank’s focus on community-centric banking, coupled with its strategic expansion into commercial services, positions it well to capitalize on emerging opportunities in the financial landscape. As the bank navigates the challenges and opportunities of the future, its commitment to innovation and customer service will remain at the forefront of its strategy.

In summary, Associated Banc-Corp’s journey over the past decade is a narrative of resilience, strategic growth, and unwavering commitment to its communities. As the bank looks to the future, its strong foundation and forward-looking approach will undoubtedly continue to drive its success in the competitive financial sector.