ATS Corp Navigates a Growing Demand for Automated Automotive Parts Feeders

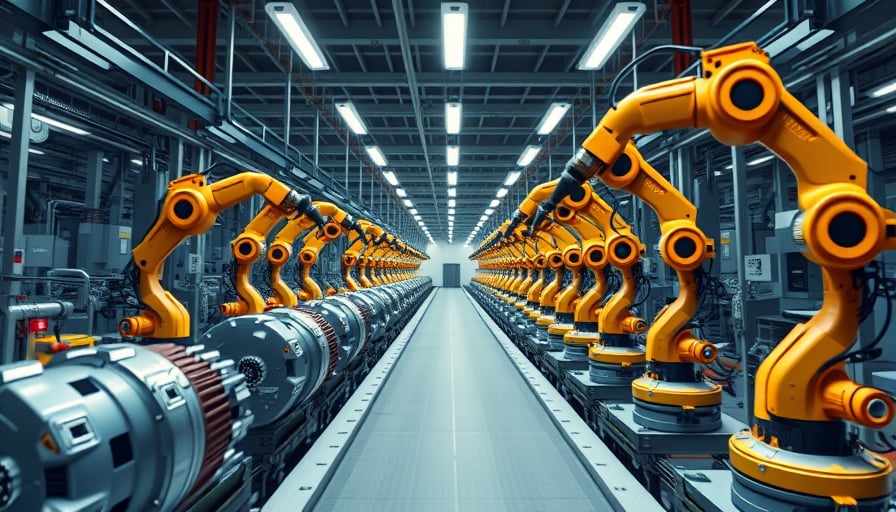

ATS Corp’s position as a leading custom engineer and producer of industrial automated manufacturing systems is poised to benefit from the projected expansion of the global automotive parts feeders market. The recent Automotive Parts Feeders Global Market Report 2025‑2029 (and 2034) issued by ResearchAndMarkets.com cites ATS Automation Tooling Systems as a key player in the sector, underscoring the company’s relevance to the automotive supply chain.

Market Outlook and ATS’s Strategic Fit

The report projects robust growth in the automotive parts feeders segment, driven by automakers’ intensifying push toward higher throughput, tighter tolerances, and reduced cycle times. ATS’s portfolio of pre‑automation and after‑sales services positions it to capture a share of this demand, as OEMs increasingly outsource complex automation solutions to specialized integrators.

ATS’s recent product innovations—particularly in high‑precision conveyor and feeder assemblies—align well with the market’s need for scalable, reliable solutions that can be rapidly deployed across diverse vehicle platforms. The company’s ability to customize systems for specific process requirements gives it a competitive edge over generic vendors.

Financial Snapshot

- Closing price (2026‑01‑04): CAD 39.95

- 52‑week high (2025‑07‑02): CAD 44.46

- 52‑week low (2025‑04‑08): CAD 29.81

- Market cap: CAD 3.71 billion

- P/E ratio: 8,207 (reflective of a highly leveraged, high‑growth environment)

Despite the elevated P/E—an artifact of the company’s aggressive investment in R&D and capacity expansion—ATS remains an attractive long‑term play for investors seeking exposure to the automation tailwinds that are reshaping the automotive sector.

Forward‑Looking Perspective

Capacity Expansion: ATS is reportedly investing in new manufacturing lines to increase output by 20 % over the next two fiscal years. This expansion will support the growing volume of feeder assemblies demanded by North American and Asian OEMs.

Digital Integration: The firm is developing an AI‑driven diagnostic platform that will enable predictive maintenance and real‑time process optimization. Early adopters in the aerospace and energy sectors have expressed interest, suggesting cross‑industry scalability.

Geographic Diversification: With a footprint in Canada, the United States, and Europe, ATS is positioning itself to capitalize on regional automotive production hubs, reducing exposure to localized supply‑chain disruptions.

Risks and Considerations

- Commodity Price Volatility: Fluctuations in steel and aluminum prices can compress margins, especially given the company’s material‑heavy product mix.

- Competitive Landscape: The automation market is highly fragmented, with several well‑capitalized entrants. ATS must continue to differentiate through engineering excellence and service depth.

- Regulatory Headwinds: Emerging environmental regulations in key markets may necessitate rapid product redesigns, adding to CAPEX requirements.

Conclusion

ATS Corp stands at the intersection of a high‑growth automation market and a strategic portfolio that caters to automotive OEMs’ evolving needs. While the company’s current valuation reflects the premium placed on growth, its disciplined execution strategy and commitment to technological innovation provide a solid foundation for sustained value creation. Investors who look beyond short‑term price volatility and focus on the company’s long‑term trajectory may find ATS Corp’s positioning compelling in the context of the automotive and broader industrial automation ecosystems.