ATS Corporation – Key Corporate and Market Highlights

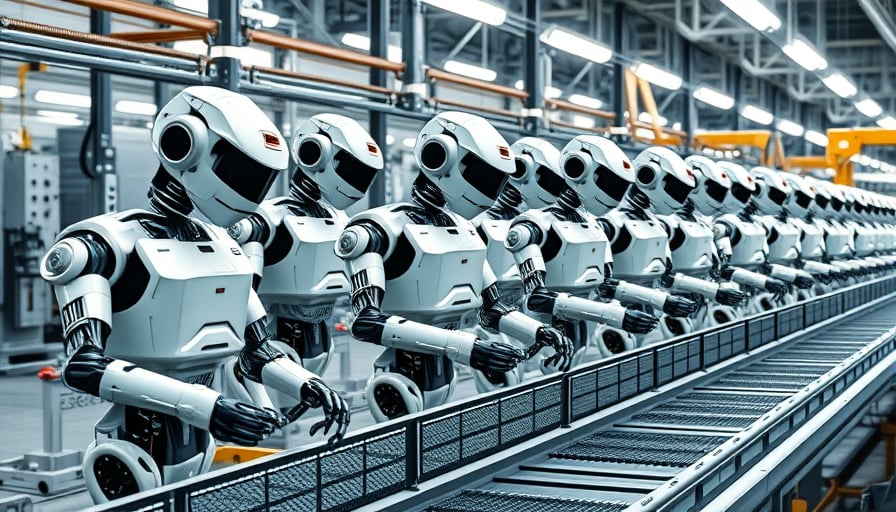

ATS Corporation, a Toronto‑stock‑exchange‑listed industrial‑machinery company, specializes in the design and manufacture of automated manufacturing systems for a broad spectrum of industries, including life sciences, chemicals, consumer products, electronics, food and beverage, transportation, energy, and oil and gas. The firm also delivers value‑added services such as pre‑automation consulting and after‑sales support.

Financial Snapshot (as of 2025‑12‑04)

| Item | Value |

|---|---|

| Close Price | CAD 37.71 |

| 52‑Week High (2024‑12‑09) | CAD 45.44 |

| 52‑Week Low (2025‑04‑08) | CAD 29.81 |

| Market Capitalization | CAD 3,655,857,920 |

| Price‑to‑Earnings Ratio | 7,520 |

The company’s share price has traded within a range of CAD 29.81 to CAD 45.44 over the past year, reflecting a significant valuation premium relative to earnings. The high P/E ratio suggests that investors expect substantial growth or that the earnings base is unusually low.

Industry Position

ATS Corporation’s product portfolio spans multiple sectors, positioning it well to capture demand for automation across diverse manufacturing environments. Its service model, which includes pre‑automation assessment and comprehensive after‑sales support, reinforces recurring revenue streams and customer loyalty.

Recent Market Activity

On 2025‑12‑08, the Toronto Stock Exchange (TSX) experienced a cautious trading day as investors awaited monetary policy announcements from the Bank of Canada and the U.S. Federal Reserve. While the broader market moved sideways, ATS shares maintained their 52‑week trend, trading near the lower end of the range.

No company‑specific news releases or earnings announcements were reported for ATS Corporation in the period immediately preceding the market activity.

Conclusion

ATS Corporation remains a specialized player in the industrial automation space, with a robust market presence and a service‑oriented business model. Its current market valuation reflects high expectations for future earnings, though the company’s price‑to‑earnings ratio indicates that investors are pricing in significant growth potential or that earnings are suppressed relative to market sentiment. Investors observing the company should monitor upcoming earnings releases, product pipeline developments, and macroeconomic factors that influence capital expenditure in the industrial automation sector.