Aya Gold & Silver Inc. Reports Record Q1-2025 Results and Secures Strategic Financing

MONTREAL, May 13, 2025 — Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF), a leading mineral exploration and development company specializing in Morocco, has announced its first quarter financial and operational results for the period ending March 31, 2025. The company reported record results, demonstrating robust operational performance and strategic financial maneuvers that have strengthened its liquidity position.

Record Q1-2025 Performance

Aya Gold & Silver achieved a remarkable silver production of 1,068,652 ounces in Q1-2025, underscoring its operational efficiency and commitment to growth. The company’s financial performance was equally impressive, with a GAAP earnings per share (EPS) of $0.05 and revenue reaching $33.8 million. These results not only reflect Aya’s operational prowess but also its ability to navigate the dynamic metals and mining sector effectively.

Strengthening Liquidity and Reaffirming Guidance

In addition to its operational success, Aya Gold & Silver has taken significant steps to bolster its financial position. The company has reaffirmed its guidance for the year, reflecting confidence in its strategic direction and future prospects. This reaffirmation comes on the heels of securing a substantial credit facility, which has further strengthened its liquidity.

US$25 Million Credit Facility from EBRD

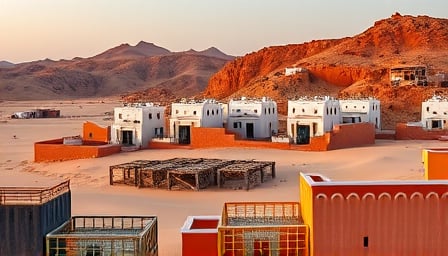

On May 12, 2025, Aya Gold & Silver announced the receipt of final internal approval from the Board of Directors of the European Bank for Reconstruction and Development (EBRD) for a proposed US$25 million secured credit facility. This strategic financing is set to support the company’s growth initiatives in Morocco, providing the necessary capital to advance its exploration and development projects.

The credit facility, secured by the EBRD, underscores the confidence of international financial institutions in Aya’s strategic vision and operational capabilities. It is expected to play a crucial role in facilitating the company’s expansion plans and enhancing its competitive position in the metals and mining industry.

Market Reaction and Outlook

The market has responded positively to Aya Gold & Silver’s record Q1-2025 results and strategic financial moves. The company’s close price on May 8, 2025, stood at CAD 10, reflecting investor confidence in its growth trajectory. With a market capitalization of CAD 1,280,435,034, Aya continues to be a significant player in the materials sector, particularly within the metals and mining industry.

Looking ahead, Aya Gold & Silver is well-positioned to capitalize on its operational strengths and strategic financial initiatives. The company’s focus on exploration and development in Morocco, coupled with its strengthened liquidity, sets the stage for sustained growth and value creation for its shareholders.

In conclusion, Aya Gold & Silver Inc.’s record Q1-2025 results and strategic financial maneuvers highlight its resilience and forward-looking approach. As the company continues to execute its growth strategy, it remains a compelling investment opportunity in the metals and mining sector.