BAIYANG: Riding the Wave of the Seafood Concept Surge

In a remarkable display of market dynamics, BAIYANG, a prominent player in the Consumer Staples sector, specifically within the Food Products industry, has seen its stock price soar to new heights. On May 15, 2025, the company’s shares hit the Shenzhen Stock Exchange’s daily limit, a testament to the burgeoning interest in the seafood concept. This surge is not an isolated event but part of a broader trend that has seen companies like BAIYANG, 国联水产 (Guolian Aquatic Products), 东方海洋 (Dongfang Ocean), and 开创国际 (Kaichuang International) leading the charge with significant gains.

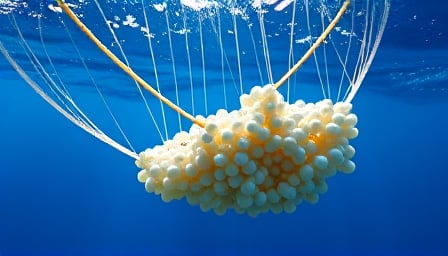

The catalyst behind this explosive growth? A palpable shift in consumer preferences towards seafood, driven by health trends and sustainability concerns. This shift has not gone unnoticed by investors, who are now flocking to companies positioned to capitalize on this trend. BAIYANG, with its robust portfolio of seafood products, stands at the forefront of this movement, leveraging its strategic position to capture market share and investor interest alike.

Financial Highlights: A Closer Look

As of May 13, 2025, BAIYANG’s close price stood at 5.51 CNY, a significant leap from its 52-week low of 3.6 CNY recorded on August 27, 2024. This upward trajectory is further underscored by its 52-week high of 6.05 CNY, achieved on March 20, 2025. These figures not only highlight BAIYANG’s resilience in a volatile market but also its potential for sustained growth in the face of shifting consumer trends.

The Market’s Verdict

The unanimous reports from stock.eastmoney.com and corroborated by sources like 每日经济新闻 (Caijing) and 南方财经网 (Southern Finance), underscore the market’s bullish stance on BAIYANG and its peers. The repeated emphasis on the “seafood concept” as a driving force behind the surge in stock prices is a clear indicator of the market’s confidence in the sector’s growth prospects.

Looking Ahead

As BAIYANG continues to navigate the choppy waters of the stock market, its recent performance serves as a beacon for investors seeking opportunities in the Consumer Staples sector, particularly within the burgeoning seafood industry. With its strategic positioning and the market’s favorable outlook, BAIYANG is poised for continued success, making it a company to watch in the months and years to come.

In conclusion, BAIYANG’s recent stock performance is not just a reflection of its own strengths but also a testament to the shifting tides in consumer preferences and market dynamics. As the seafood concept continues to gain momentum, BAIYANG stands ready to ride the wave, promising exciting prospects for investors and stakeholders alike.