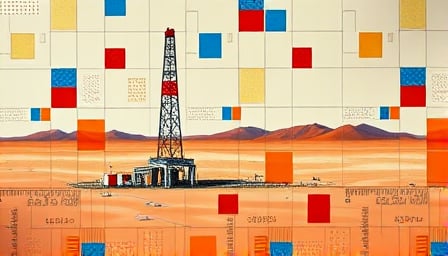

Baker Hughes Co Secures Major Contract, Boosts Stock Performance

Baker Hughes Co, a leading energy equipment and service provider, has recently secured a significant multi-year contract to supply drag-reducing agents for two major offshore pipelines. This contract is pivotal for enhancing the transport of oil along the U.S. Gulf Coast, promising to increase pipeline capacity, reduce operational friction, and improve the flexibility of crude handling.

The company, which operates globally in sectors such as surface logging, drilling, pipeline operations, petroleum engineering, and fertilizer solutions, has seen its stock price surge by over 9% following the announcement. This increase is attributed to the company’s strong quarterly earnings, which surpassed analysts’ expectations. Baker Hughes reported earnings per share of $0.63, exceeding the anticipated $0.55, and demonstrated a notable improvement in both revenue and net margin.

As of July 24, 2025, Baker Hughes Co’s stock closed at $46.05, reflecting a positive market response. The company’s 52-week high was recorded at $49.4 on February 5, 2025, while the 52-week low stood at $32.25 on September 10, 2024. With a market capitalization of $45.07 billion, Baker Hughes continues to be a significant player in the energy sector.

The favorable earnings report has contributed to a broader rally in the NASDAQ 100 index, driven by positive market sentiment. Baker Hughes Co’s strategic contract and robust financial performance underscore its strong position in the energy equipment and services industry, reinforcing investor confidence in its future growth prospects.