Ball Corporation, a prominent player in the materials sector, continues to maintain its position as a key provider of metal packaging solutions for beverages, foods, and household products. Headquartered in Westminster, the U.S.-based company also extends its expertise to aerospace and other technologies, serving both commercial and governmental clients worldwide. As of February 22, 2026, Ball Corporation’s stock is trading on the New York Stock Exchange under the ticker symbol BALL, with a closing price of USD 66.53 as of February 19, 2026.

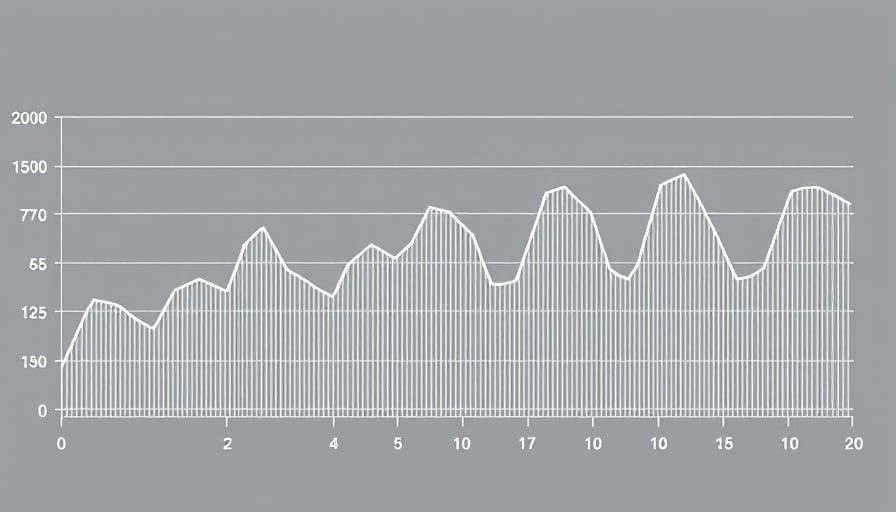

The company’s financial performance over the past year has been noteworthy. The stock price has fluctuated within a range, reaching a 52-week high of USD 68.29 on February 10, 2026, and a 52-week low of USD 43.51 on April 8, 2025. This range reflects a recovery and stabilization in the company’s market valuation, with the current price standing well above the previous year’s low. The market capitalization of Ball Corporation is valued at approximately USD 17.7 billion, underscoring its significant presence in the industry.

Ball Corporation’s valuation metrics, including a price-to-earnings (P/E) ratio of 20.01 and a price-to-book (P/B) ratio of 3.33, align with typical standards for industrial-materials firms. The P/E ratio indicates that the market values the company at about 20 times its earnings, suggesting investor confidence in its future growth prospects. Meanwhile, the P/B ratio of 3.33 reflects a valuation that is 3.3 times its book value, a common benchmark for companies in this sector.

As of the latest updates, Ball Corporation has not announced any new developments since its participation in the Bank of America’s Global Agriculture and Materials Conference on February 17, 2026. The company’s strategic focus remains on leveraging its expertise in metal packaging and expanding its technological offerings to meet the evolving needs of its diverse clientele.

In summary, Ball Corporation’s recent financial performance and market positioning highlight its resilience and adaptability in a competitive industry. With a robust market cap and favorable valuation metrics, the company is well-positioned to continue its growth trajectory, supported by its comprehensive portfolio of products and services.