Bayan Mining and Minerals Ltd: A Critical Examination of Its Financial Turmoil

In the volatile world of mining and materials, Bayan Mining and Minerals Ltd stands as a stark reminder of the sector’s inherent risks and uncertainties. Despite its ambitious endeavors in the lithium-borate market, the company’s financial health raises significant concerns, casting a shadow over its future prospects.

Financial Instability: A Red Flag for Investors

As of August 21, 2025, Bayan Mining and Minerals Ltd’s share price languished at a mere 0.205 AUD, a far cry from its 52-week high of 0.215 AUD. This stagnation is alarming, especially when juxtaposed with the company’s 52-week low of 0.027 AUD, highlighting a volatile trajectory that investors should approach with caution. The market capitalization of 15,890,000 AUD further underscores the precarious position Bayan finds itself in, struggling to assert its presence in the competitive mining sector.

The Earnings Conundrum

A particularly troubling aspect of Bayan’s financial landscape is its Price Earnings (P/E) ratio of -4.09. This negative figure is not just a number; it’s a glaring red flag signaling that the company is not generating profits. In an industry where margins can be razor-thin, a negative P/E ratio is a harbinger of potential financial distress, questioning the company’s ability to sustain its operations and growth in the long term.

Lithium-Borate Ventures: A Double-Edged Sword

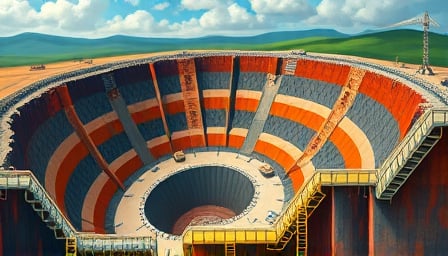

Bayan Mining and Minerals Ltd prides itself on its specialization in lithium-borate projects, positioning itself as a global supplier in this niche market. While the demand for lithium, a critical component in batteries for electric vehicles and renewable energy storage, is on the rise, the company’s ability to capitalize on this trend remains uncertain. The volatile nature of commodity prices, coupled with the technical and environmental challenges of lithium-borate extraction, poses significant risks to Bayan’s operational viability and profitability.

A Call for Strategic Reevaluation

Given the current financial indicators and market dynamics, Bayan Mining and Minerals Ltd stands at a crossroads. The company’s leadership must undertake a strategic reevaluation to navigate the tumultuous waters of the mining sector. This includes reassessing its project portfolio, optimizing operational efficiencies, and exploring strategic partnerships or alternative revenue streams to bolster its financial standing.

Conclusion: A Precarious Future

Bayan Mining and Minerals Ltd’s journey in the lithium-borate market is fraught with challenges. The company’s financial instability, underscored by its negative P/E ratio and volatile share price, demands immediate attention. As Bayan strives to carve out its niche in the global mining landscape, it must confront the harsh realities of its current predicament. Only through decisive action and strategic foresight can Bayan hope to secure a more stable and prosperous future. Investors and stakeholders alike should watch closely, as the company’s next moves could very well determine its fate in the competitive arena of mining and materials.