Beijing Wandong Medical Technology Co Ltd: A Focus on Innovation and Sustainability

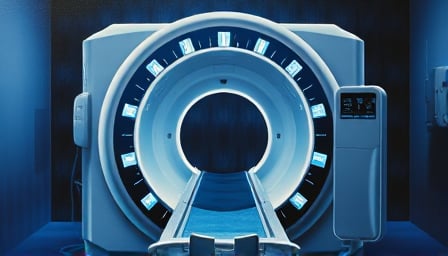

Beijing Wandong Medical Technology Co Ltd, a prominent player in the health care equipment and supplies sector, has recently been in the spotlight due to significant developments in its operations and strategic initiatives. Listed on the Shanghai Stock Exchange, the company is known for its production of medical imaging equipment, including X-ray machines, high-frequency digital gastrointestinal equipment, and resonance imaging machines. Additionally, it offers veterinary imaging solutions and medical equipment maintenance services.

Innovative Developments in Medical Imaging

In a recent visit by the President of the China Medical Equipment Association, Hou Yan, to Beijing Wandong Medical Technology, the company showcased its commitment to innovation. The CEO, Song Jinsheng, highlighted the company’s focus on “product leadership” as a core strategy. Under the strong support of Midea Group, Beijing Wandong Medical Technology is constructing a research and development matrix that includes the Midea Central Research Institute, Medical Equipment Research Institute, AI Research Institute, and Beijing Wandong Research Institute. This collaborative effort aims to tackle key technologies and develop innovative products, accelerating the intelligent iteration and upgrade of high-end medical equipment.

A significant highlight of the visit was the discussion on the third-generation liquid helium-free MRI technology. This breakthrough technology eliminates the dependency on liquid helium, a critical advancement given that traditional 1.5T MRI machines require approximately 2000 liters of liquid helium for initial filling, resulting in about 15 tons of CO2 emissions during helium gas production and supply. The liquid helium-free technology not only reduces operational costs but also provides a tangible path for the industry’s green transformation. President Hou Yan praised this innovation, emphasizing its importance in reducing energy consumption and emissions, aligning with China’s “dual carbon” strategy.

Financial Movements and Share Buyback Plan

In financial news, Beijing Wandong Medical Technology experienced notable activity on August 29, 2025. The company received financing purchases amounting to 2.79 million yuan, accounting for 25.73% of the day’s inflow of funds. The current financing balance stands at 56 million yuan, representing 4.49% of the circulating market value, which is below the historical 40% percentile.

Additionally, the company announced a share buyback plan, intending to repurchase up to 2.4 million shares at a maximum price of 25 yuan per share. The total buyback amount is capped at 60 million yuan. This move is part of a strategy to enhance the company’s long-term incentive mechanisms, boost employee motivation, and strengthen team cohesion and competitiveness. The repurchased shares will be utilized for employee stock plans or equity incentives.

Market Position and Outlook

As of August 28, 2025, Beijing Wandong Medical Technology’s closing price was 17.73 CNH, with a 52-week high of 19.28 CNH and a low of 11.81 CNH. The company’s market capitalization is 124.6 billion CNH, with a price-to-earnings ratio of 102.78. These figures reflect the company’s strong market position and investor confidence in its growth potential.

In summary, Beijing Wandong Medical Technology continues to lead in innovation within the medical equipment sector, with strategic initiatives that not only enhance its product offerings but also contribute to environmental sustainability. The company’s recent financial activities and strategic share buyback plan further underscore its commitment to long-term growth and shareholder value.