The Surge of FUD Around Binance and its Implications for Token Listing Dynamics

On January 28, 2026, former Binance CEO Changpeng Zhao (CZ) publicly denounced a wave of online criticism as a “coordinated attack” aimed at the exchange. The outcry, amplified by posts on social media platforms such as prot and cryptopanic, focused on Binance’s handling of token listings, particularly the “10/10” event that had attracted scrutiny over its perceived influence on market sentiment. CZ’s statement was swift and uncompromising: the criticism he faced was not a matter of legitimate market concern but an orchestrated campaign to undermine Binance’s reputation.

Shortly thereafter, CZ addressed another flashpoint: his tweet encouraging a “buy and hold” strategy. In a response published by cryptonews.com, he clarified that his message was not a directive for market manipulation but rather a call for long‑term crypto adoption. By framing the tweet as a broader vision for the sector, CZ sought to quell accusations that Binance was attempting to engineer price movements for its own benefit.

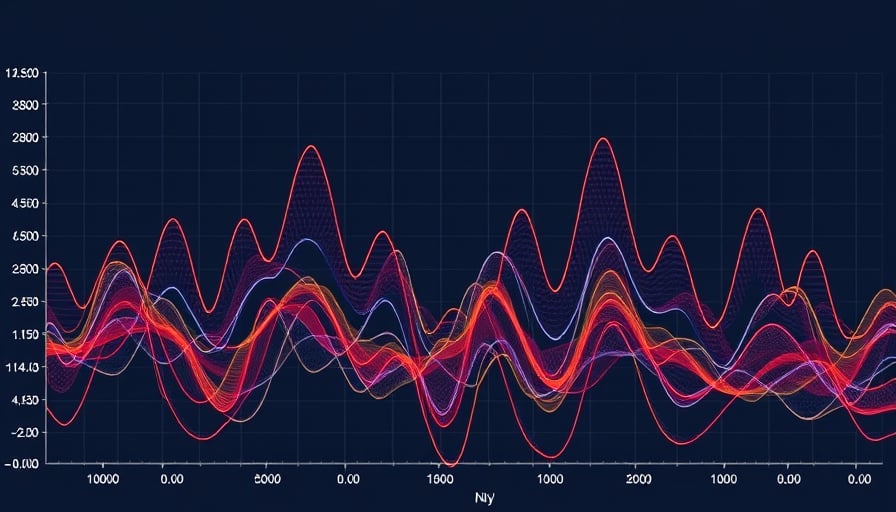

The flurry of negative commentary and the subsequent defense have amplified a broader debate that has been simmering throughout 2025. The cryptoRank analysis released on January 29, 2026 underscores this trend. Between January 1 and December 31, 2025, Binance listed 100 new tokens, of which 93 traded in the red. The median return on investment (ROI) for Binance‑listed tokens was a modest 0.22×. Bybit, with 150 listings, recorded 127 red‑traded tokens and a median ROI of 0.23×. MEXC, the most active centralized exchange with 878 listings, saw 747 tokens in the negative and a median ROI of 0.21×. Even Coinbase, which had the highest median ROI at 0.43×, struggled with 94 out of 111 listings trading lower.

These figures are mirrored on decentralized platforms such as Hyperliquid, where a parallel analysis of token performance yielded comparable results. The convergence of data across both centralized and decentralized venues suggests that the weakness in new token performance is less a fault of any single exchange and more a symptom of the broader market environment.

Market Conditions and the Erosion of Passive Strategies

The cumulative impact of more than 11 million new tokens in 2025—many described by industry observers as “low‑quality”—has diluted the effectiveness of passive investment strategies. CryptoRank notes that the total crypto market capitalization fell below $3 trillion by January 2026, a decline of over $1 trillion since October. This contraction underscores the heightened risk that investors face when adopting a “just buy and hold” or dollar‑cost averaging approach.

Analysts such as Aporia contend that the early days of crypto were a fertile ground for passive strategies: the market was still being discovered, and there were few large‑scale competitors or sophisticated algorithms to erode an investor’s position. Today, however, the sector is saturated with high‑frequency trading bots, institutional funds, and even predatory actors who exploit conviction as exit liquidity. In such a landscape, simply holding an asset may no longer guarantee upside; instead, it can expose investors to systematic underperformance if the asset itself fails to sustain momentum.

The Implications for Binance’s Future

CZ’s recent defense and the data from cryptoRank converge to paint a nuanced picture. On one hand, Binance’s listing volume remains robust, but the majority of new tokens underperform. On the other, the exchange’s public image has been rattled by accusations that it is orchestrating market conditions to its advantage. While CZ’s statements aim to position Binance as a steward of long‑term crypto adoption, the empirical evidence suggests that the market’s structural shifts may be eroding the very passive strategies he champions.

For stakeholders—whether they are retail investors, institutional participants, or competing exchanges—the lesson is clear: in a market where the token supply has exploded and liquidity is increasingly fragmented, relying solely on “buy and hold” or “DCA” is fraught with risk. Strategic token selection, rigorous due diligence, and a nuanced understanding of market dynamics will become paramount if participants wish to navigate the post‑2025 crypto landscape successfully.