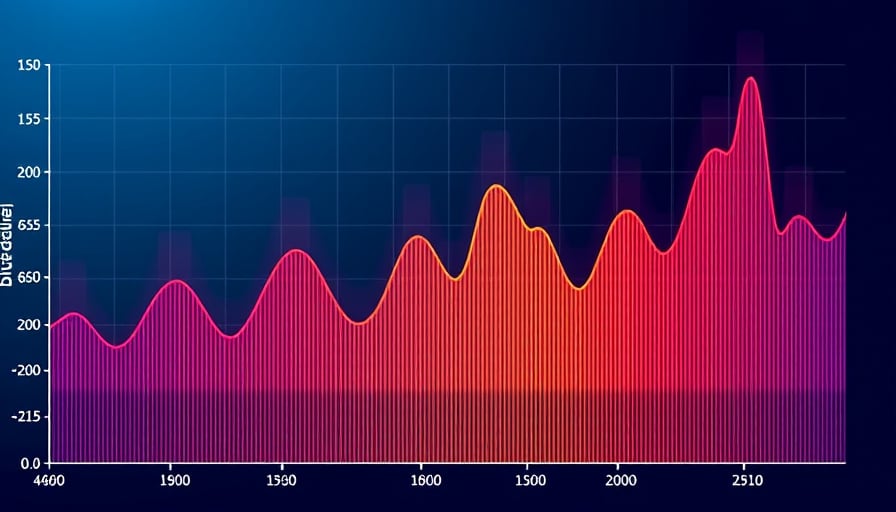

In the ever-evolving landscape of cryptocurrency, BitcoinOS emerges as a noteworthy contender, albeit with a market presence that raises critical questions about its valuation and potential. As of December 10, 2025, BitcoinOS’s close price stood at a modest $0.00306832, a figure that starkly contrasts with its 52-week high of $0.0120446 recorded on October 28, 2025. This volatility underscores the inherent risks and uncertainties that investors face in the crypto market.

The recent 52-week low of $0.00175302, observed on November 30, 2025, further highlights the precarious nature of BitcoinOS’s market performance. Such fluctuations are not uncommon in the cryptocurrency realm, yet they demand a rigorous analysis of the underlying factors driving these changes. Investors and market analysts alike must scrutinize the catalysts behind BitcoinOS’s price movements to make informed decisions.

With a market capitalization of approximately $13,146,192.72, BitcoinOS occupies a niche position within the broader cryptocurrency ecosystem. This valuation prompts a critical examination of the asset’s fundamentals and its ability to sustain growth in a highly competitive market. The relatively low market cap suggests that BitcoinOS may be perceived as a high-risk, high-reward investment, appealing to a specific segment of the crypto community that is willing to embrace volatility in pursuit of potential gains.

The currency’s performance over the past year raises important questions about its long-term viability and the strategic initiatives required to enhance its market standing. As the cryptocurrency landscape continues to evolve, BitcoinOS must navigate a complex array of challenges, including regulatory scrutiny, technological advancements, and shifting investor sentiment.

In conclusion, while BitcoinOS presents intriguing opportunities for investors seeking to diversify their portfolios, it is imperative to approach this asset with caution. The volatile price history and modest market cap necessitate a thorough evaluation of the risks involved. As the crypto market marches forward, BitcoinOS must demonstrate resilience and adaptability to secure its place in the future of digital finance.