BlackSky Technology Inc., a prominent player in the industrials sector, has been making waves with its innovative approach to geospatial intelligence. Based in Philadelphia and listed on the New York Stock Exchange, BlackSky has carved out a niche by offering real-time geospatial intelligence solutions. This capability is crucial in today’s data-driven world, where timely and accurate information can be the difference between success and failure.

As of October 7, 2025, BlackSky’s stock closed at $30.07, reflecting a robust performance with a 52-week high of $31.79. However, it’s worth noting that the company’s journey has not been without its challenges. The 52-week low, recorded on October 10, 2024, was a mere $5.85, highlighting the volatility and risks inherent in the tech sector. Despite these fluctuations, BlackSky’s market capitalization stands at a formidable $863.56 million, underscoring investor confidence in its long-term potential.

One of the most striking aspects of BlackSky’s financial profile is its price-to-earnings ratio of -9.627. This negative figure is indicative of the company’s current lack of profitability, a common scenario for high-growth tech firms that prioritize expansion and market capture over immediate financial returns. While this may raise eyebrows among traditional investors, it is a calculated risk that BlackSky is willing to take to secure its position as a leader in geospatial intelligence.

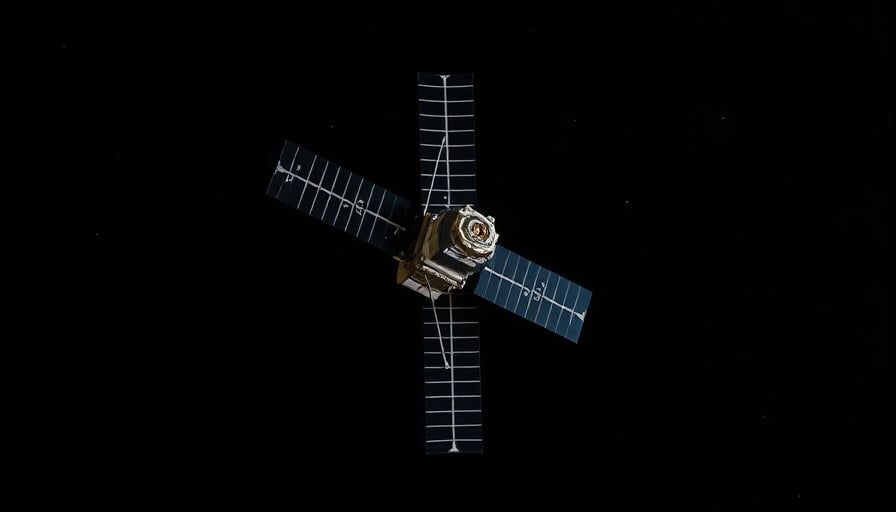

BlackSky’s core competency lies in its ability to process and analyze data from a diverse array of sources. By integrating observations from space, air, environmental sensors, asset tracking sensors, industrial IoT, and internet-enabled narrative sources, BlackSky provides a comprehensive view of the world. This capability is not just a technical marvel but a strategic asset that serves a global customer base across various industries, including defense, energy, and logistics.

The company’s innovative approach is not without its critics. Skeptics argue that the reliance on such a wide range of data sources could lead to information overload and potential inaccuracies. However, BlackSky’s commitment to leveraging advanced algorithms and machine learning techniques ensures that the data is not only vast but also precise and actionable.

In conclusion, BlackSky Technology Inc. stands at a critical juncture. Its ability to navigate the complexities of the geospatial intelligence market will determine its future trajectory. While the current financial metrics may not paint a rosy picture, the company’s strategic investments in technology and data integration position it well for future growth. As the world becomes increasingly reliant on real-time data, BlackSky’s role as a provider of cutting-edge geospatial solutions will only become more vital.