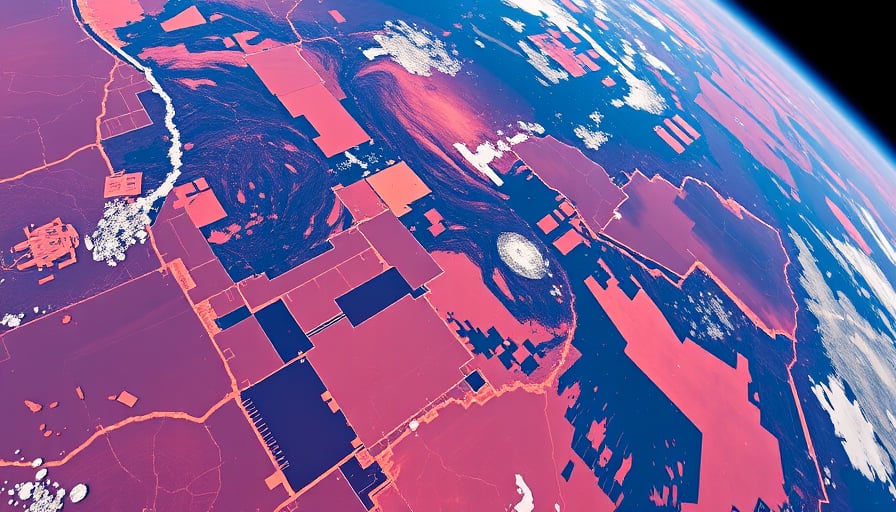

BlackSky Technology Inc., an American company headquartered in Philadelphia, has been making significant strides in the geospatial intelligence sector. As a key player in the industrials sector, BlackSky specializes in delivering real-time geospatial intelligence solutions. The company processes data from a diverse array of sources, including space, air, environmental sensors, asset tracking sensors, industrial IoT, and internet-enabled narrative sources. This comprehensive approach enables BlackSky to serve a global customer base effectively.

As of December 3, 2025, BlackSky’s stock was trading at a close price of $19.25 on the New York Stock Exchange. The company’s market capitalization stands at approximately $631 million USD. Over the past year, BlackSky’s stock has experienced significant volatility, reaching a 52-week high of $33.198 on October 14, 2025, and a 52-week low of $6.15 on April 6, 2025. This fluctuation reflects the dynamic nature of the geospatial intelligence market and the broader economic conditions impacting the industrials sector.

Despite its innovative offerings, BlackSky’s financial metrics indicate challenges. The company’s price-to-earnings ratio is currently at -6.4, suggesting that it is not yet profitable. This negative ratio may be attributed to the substantial investments required for research and development, as well as the expansion of its technological capabilities and customer base.

BlackSky’s business model revolves around leveraging advanced technologies to provide actionable intelligence. By integrating data from various sources, the company offers insights that are crucial for decision-making in numerous industries, including defense, energy, and logistics. This capability positions BlackSky as a vital resource for organizations seeking to enhance their operational efficiency and strategic planning.

In summary, BlackSky Technology Inc. continues to be a prominent entity in the geospatial intelligence landscape. While it faces financial challenges, its innovative approach and comprehensive data integration capabilities underscore its potential for growth and influence in the industrials sector. As the company navigates the complexities of the market, its focus on technological advancement and customer service remains central to its strategy.