BlueScope Steel Ltd: A Buy‑back That Says More Than It Saves

BlueScope Steel Ltd (ASX: BSL) announced a daily buy‑back on 9 December 2025, purchasing 42,015 shares that day and bringing the cumulative repurchase to 65,561,782 shares since the first notification on 16 August 2021. The move is framed as an ordinary, fully‑paid buy‑back under the ASX Listing Rule 3C, yet its implications for shareholders and the company’s valuation are far from benign.

1. A Numbers Game That Masks Cash Flow Strains

BSL’s market cap hovers at A$10.5 billion, while its price‑to‑earnings ratio soars at 141.04. The stock has traded between A$18.60 and A$69.84 over the past year, now sitting near A$23.70. Such a high P/E is not merely a reflection of growth prospects; it is a symptom of an over‑valued market that the company is desperate to tame. By buying back shares, BlueScope attempts to reduce the share count, thereby inflating earnings per share (EPS) and temporarily nudging the price upwards. The tactic offers little value to long‑term investors who must still contend with the company’s core profitability.

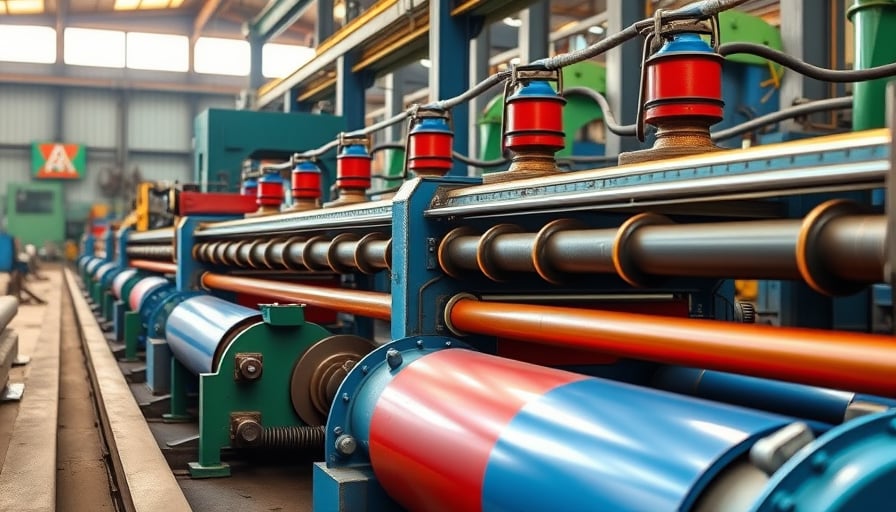

The company’s core business—producing steel slabs, plates, and coated strips for construction, automotive, and manufacturing—has faced mounting pressure from global supply‑chain disruptions and a slowdown in the construction sector. Even if the buy‑back is executed at market price, it does not address the underlying cash‑flow weakness that has led to a recent decline in the share price.

2. Shareholder Value: Short‑Term Boost, Long‑Term Questionable

Buy‑backs are often touted as a way to reward shareholders by returning excess cash. However, BlueScope’s 2025 financials show a modest operating margin and a modest dividend payout. With earnings still lagging behind the inflated P/E, the buy‑back merely serves as a cosmetic exercise, giving the appearance of confidence while the company’s earnings remain under pressure.

From a critical standpoint, the buy‑back could be seen as a strategic attempt to appease price‑sensitive investors ahead of a possible restructuring or cost‑cutting programme. By reducing the number of shares, the company can project a healthier EPS figure, even though the underlying fundamentals have not improved. Investors who focus solely on the headline numbers risk being misled by what is essentially a financial sleight of hand.

3. Regulatory Transparency and Market Integrity

The ASX listing rule requires disclosure of daily buy‑back amounts, and BlueScope complied with that requirement, publishing the figure of 42,015 shares purchased. While the transparency is commendable, the rule also stipulates that the company must disclose the purpose of the buy‑back. In this case, BlueScope’s announcement does not elaborate beyond the mechanical details. This lack of context raises concerns about market integrity: if the buy‑back were intended to support the share price artificially, it could be construed as market manipulation, an action that would trigger scrutiny from regulators and could erode investor trust.

4. The Bigger Picture: A Sector Under Stress

BlueScope operates in the metals and mining industry, a sector that has been grappling with volatile commodity prices and geopolitical uncertainties. While the company’s product lines—particularly the coated and painted strip products—have niche applications, they are still subject to the same macro‑economic headwinds that affect the broader steel market. In such an environment, a buy‑back is unlikely to offset the systemic risks that drive down the company’s valuation over the long term.

5. What Should Investors Do?

- Scrutinise the Cash Flow: Look beyond the headline P/E and evaluate whether BlueScope’s cash‑flow generation is sufficient to justify the buy‑back.

- Consider the Timing: The 9 December 2025 buy‑back appears timed to coincide with year‑end reporting and possibly to influence the quarterly earnings report.

- Watch for Future Announcements: Any subsequent buy‑backs or dividend changes should be weighed against the company’s operational performance and debt levels.

In conclusion, BlueScope Steel’s recent buy‑back is a textbook example of how a company can use share repurchase as a short‑term tool to manage market perception without addressing deeper financial weaknesses. Investors who seek genuine value creation should look beyond the surface and ask whether the underlying business fundamentals can sustain a high valuation, or if the company is simply playing a game of numbers.