BranchOut Food Inc. – Company Overview

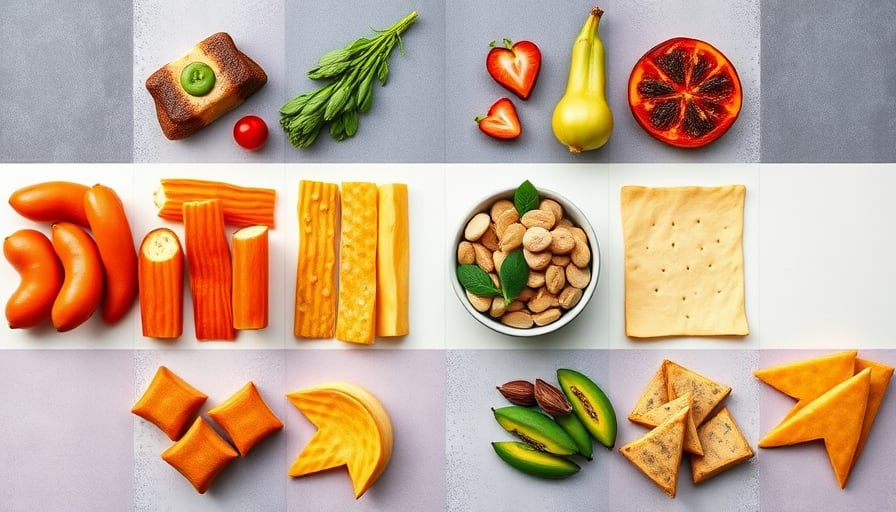

BranchOut Food Inc. is a United States‑based public company listed on the Nasdaq exchange. The firm specializes in the manufacturing and marketing of plant‑based dehydrated foods, including a range of fruit and vegetable snacks such as avocado chips, chewy banana bites, pineapple chips, and Brussels sprout crisps.

Key Financial Metrics (as of 2025‑11‑10)

| Item | Value |

|---|---|

| Share price | USD 3.23 |

| 52‑week high | USD 3.37 |

| 52‑week low | USD 1.53 |

| Market capitalization | USD 37,470,000 |

| Price‑to‑earnings ratio | –3.34 |

Sector and Currency

- Sector: Consumer Staples

- Currency: USD

Recent Disclosure Activity

The company has not filed any recent earnings releases or regulatory disclosures that directly impact its financial performance or share price as of the date provided. All publicly available information is derived from the fundamental data above.

Analytical Context

- The negative price‑to‑earnings ratio indicates that BranchOut Food Inc. is either reporting negative earnings or its earnings are insufficient to justify the current share price.

- The share price has fluctuated between USD 1.53 and USD 3.37 over the last year, reflecting modest volatility typical of a small consumer‑staples company.

- With a market cap of roughly USD 37.5 million, the firm is a small-cap entity, which may lead to higher sensitivity to market swings and limited liquidity compared to larger peers.

Market Position

BranchOut Food Inc. operates within the growing niche of plant‑based snacks. While the broader consumer‑staples sector is generally stable, the plant‑based segment is subject to changing consumer preferences and competition from both specialty and mainstream brands. The company’s product portfolio—fruit and vegetable‑based chips and bites—positions it to capture trends toward healthier, plant‑derived snack options.

Conclusion

As of 10 November 2025, BranchOut Food Inc. remains a small, plant‑based snack manufacturer with a modest market presence and a negative price‑to‑earnings ratio. No recent earnings announcements or significant corporate actions have been disclosed. Investors and analysts should monitor future financial statements and market developments for changes in profitability, revenue growth, and strategic initiatives that could affect the company’s valuation.