Cadrenal Therapeutics Inc: A Beacon of Hope or a Risky Venture?

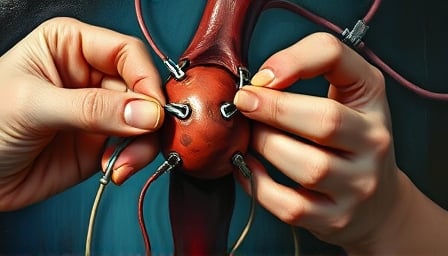

In the ever-evolving landscape of the healthcare sector, Cadrenal Therapeutics Inc stands out as a biotech company with a bold vision. Specializing in the development of tecarfarin, a novel therapy with orphan drug indication, Cadrenal aims to tackle systemic thromboembolism (blood clots) of cardiac origin in patients with end-stage renal disease (ESRD) and atrial fibrillation. But is this innovative approach a beacon of hope or a risky venture?

A Promising Innovation

Cadrenal Therapeutics has positioned itself as a pioneer with its focus on tecarfarin, a drug designed to prevent life-threatening blood clots in a vulnerable patient population. The company’s commitment to addressing the needs of patients with ESRD and atrial fibrillation is commendable, given the high risk of thromboembolic events in these groups. With its orphan drug designation, tecarfarin not only promises to fill a critical gap in treatment but also offers Cadrenal potential market exclusivity, a significant advantage in the competitive biotech arena.

Financial Performance: A Mixed Bag

Despite the promising potential of tecarfarin, Cadrenal’s financial performance paints a mixed picture. As of May 5, 2025, the company’s close price stood at $15.68, a significant drop from its 52-week high of $22.9011 on February 25, 2025. This decline reflects investor skepticism, possibly fueled by the inherent risks associated with biotech ventures and the challenges of bringing a novel therapy to market.

Moreover, the company’s price-to-earnings ratio of -1.93 underscores the lack of profitability, a common hurdle for biotech firms in the development phase. With a market capitalization of $32,010,000, Cadrenal’s financial metrics highlight the precarious balance between innovation and financial viability.

The IPO and Beyond

Cadrenal Therapeutics made its public debut on the Nasdaq stock exchange on January 19, 2023. The initial public offering was a critical step in raising capital to fund the development of tecarfarin. However, the journey from IPO to profitability is fraught with challenges, including rigorous clinical trials, regulatory hurdles, and the daunting task of market penetration.

Global Reach and Accessibility

Despite these challenges, Cadrenal Therapeutics serves customers worldwide, leveraging its online presence through its website, www.cadrenal.com . This global reach is crucial for a biotech company aiming to make a significant impact on healthcare. However, the question remains: can Cadrenal effectively translate its innovative therapy into widespread clinical use and financial success?

Conclusion: A High-Stakes Gamble

Cadrenal Therapeutics Inc stands at a crossroads, embodying the high-stakes gamble inherent in the biotech industry. On one hand, tecarfarin represents a groundbreaking advancement in the prevention of thromboembolic events in high-risk patients. On the other hand, the company’s financial struggles and the uncertain path to market success pose significant risks.

As investors and healthcare professionals watch closely, the future of Cadrenal Therapeutics will hinge on its ability to navigate the complex landscape of drug development and commercialization. Will tecarfarin become the beacon of hope it promises to be, or will it succumb to the myriad challenges facing biotech innovators? Only time will tell.