Caterpillar Inc. Reaches New Heights Amid AI‑Driven Power Demand

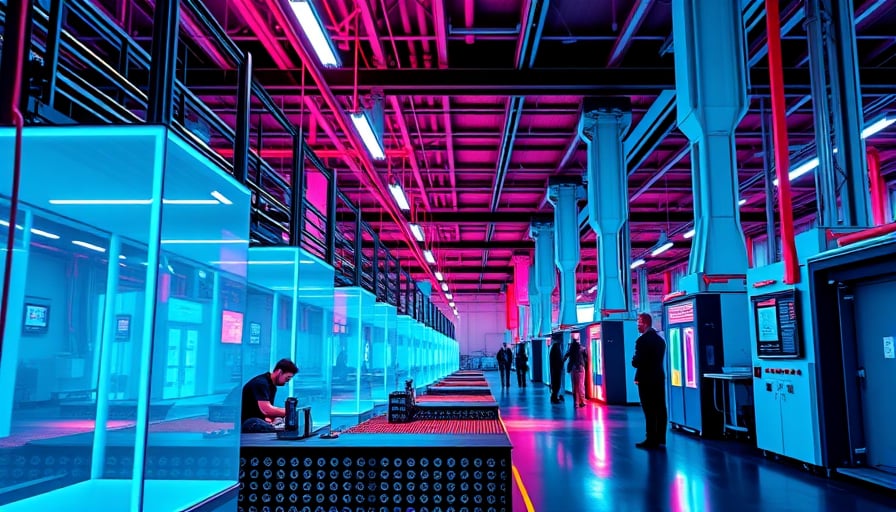

Caterpillar Inc. (NYSE: CAT) delivered an unexpectedly robust fourth‑quarter performance that surpassed Wall Street forecasts, setting the stage for a record‑breaking year‑end. The company’s earnings were bolstered by a surge in power‑generation sales to artificial‑intelligence (AI) data centers, a sector that has intensified its demand for reliable, high‑capacity electricity.

Earnings Beat Driven by Data‑Center Demand

Analysts noted that the company’s revenue and operating margin grew significantly, largely due to the sale of power‑generation equipment to AI‑focused data centers. The surge in electricity requirements for machine‑learning workloads created a new, high‑margin customer base for Caterpillar’s turbine and generator lines. In its earnings call, management emphasized that this niche has already begun to reshape the company’s traditional construction‑machinery revenue mix.

Record Revenues and Cash Flow

Caterpillar posted a record total revenue for the quarter, with cash flow from operations remaining strong. The company’s ability to generate significant cash has enabled it to pursue aggressive share repurchase programs, further supporting the share price. Bloomberg reported that the combined effect of record sales, healthy cash flow, and buybacks has lifted investor sentiment, driving the stock higher on the day of the announcement.

Barclays Raises Target

Following the earnings release, Barclays lifted its price target for Caterpillar, citing the company’s new revenue streams and improved profitability. The bank highlighted the strategic importance of the data‑center segment and anticipated continued upside as AI adoption accelerates worldwide.

Backlog Hits a Record High

Financial post and Morningstar analysis revealed that Caterpillar’s backlog reached a record level, reflecting heightened demand for both its construction machinery and power‑generation solutions. The backlog growth underscores the company’s market position and suggests a sustained pipeline of revenue for the coming quarters.

Tariff Headwinds

While the quarter was largely positive, analysts pointed out that tariff pressures on certain components could temper growth. The Morningstar report noted that tariffs have introduced cost uncertainty for specific parts, potentially impacting margins if the tariffs persist or expand.

Financial Snapshot

| Metric | 2025‑Q4 |

|---|---|

| Net Income | $2.402 billion |

| Earnings per Share | $5.12 |

| Market Capitalisation | $303.44 billion |

| Price‑Earnings Ratio | 35.321 |

| Closing Price (2026‑01‑28) | $665.24 |

Caterpillar’s share price hovered near its 52‑week high of $679.99, reflecting the market’s confidence in the company’s expanded product portfolio and the long‑term prospects of AI‑driven power consumption.

Outlook

With its diversified business model and new foothold in the AI power‑generation niche, Caterpillar is well‑positioned to sustain growth through the remainder of 2025 and into 2026. The company’s continued emphasis on cash flow generation and share repurchase programmes suggests a focus on delivering shareholder value even as it navigates tariff challenges.