CCS Supply Chain Management Co Ltd: A Snapshot of Recent Performance and Operations

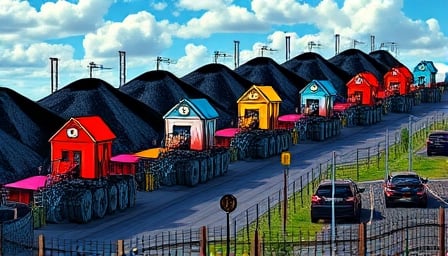

CCS Supply Chain Management Co., Ltd., a prominent player in the industrials sector, specializes in trading companies and distributors. The company is renowned for its comprehensive supply chain management services, including financing and supply chain portable services. Its primary focus lies in the coal, iron, and cotton trading sectors. Listed on the Shanghai Stock Exchange, CCS Supply Chain Management Co., Ltd. has been a significant entity since its Initial Public Offering (IPO) on June 8, 1998.

Recent Financial Performance

As of April 23, 2025, CCS Supply Chain Management Co., Ltd. reported a close price of 4.39 CNH. The company’s stock has experienced fluctuations over the past year, with a 52-week high of 6.06 CNH on April 10, 2025, and a 52-week low of 3.38 CNH on September 17, 2024. The market capitalization stands at 4,970,000,000 CNH, reflecting its substantial presence in the market.

Valuation Metrics

The company’s Price Earnings (P/E) ratio is currently 285.09, indicating a high valuation relative to its earnings. This metric suggests investor confidence in the company’s future growth prospects, despite the high ratio.

Operational Focus

CCS Supply Chain Management Co., Ltd. continues to concentrate its efforts on the coal, iron, and cotton trading areas. The company’s strategic focus on these commodities underscores its commitment to leveraging its expertise in supply chain management to optimize operations and enhance profitability.

For more detailed information about CCS Supply Chain Management Co., Ltd.’s offerings and services, interested parties can visit their official website at www.ccsoln.com .