CCSC Technology International Holdings Ltd: Navigating Challenges and Opportunities

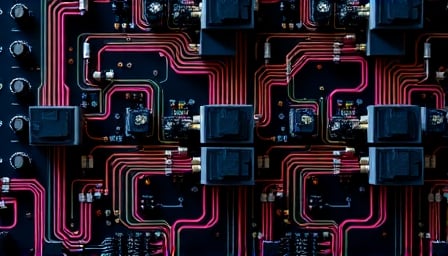

In the dynamic landscape of the information technology sector, CCSC Technology International Holdings Ltd. stands as a notable player, primarily engaged in the manufacturing and distribution of interconnect products such as connectors, cables, and wire harnesses. Despite facing recent market challenges, the company continues to serve a global customer base through its subsidiaries, maintaining its presence on the Nasdaq stock exchange.

As of August 20, 2025, CCSC’s stock closed at $1.08, reflecting a significant decline from its 52-week high of $3.17 on October 23, 2024. This downturn is further underscored by a 52-week low of $0.99, recorded on June 12, 2025. The company’s market capitalization currently stands at $12,180,000, with a price-to-earnings ratio of -8.866, indicating a challenging financial period.

Despite these hurdles, CCSC’s strategic positioning in the interconnect products market offers potential for recovery and growth. The company’s focus on innovation and quality in its product offerings continues to be a cornerstone of its business model. By leveraging its global network and expertise, CCSC aims to capitalize on emerging opportunities within the technology sector.

Investors and industry observers are closely monitoring CCSC’s efforts to navigate the current market volatility. The company’s ability to adapt to changing market conditions and its commitment to maintaining strong customer relationships are seen as critical factors in its potential turnaround.

For more information on CCSC Technology International Holdings Ltd., stakeholders are encouraged to visit the company’s official website at www.ccsc-interconnect.com . As the company moves forward, its strategic initiatives and market adaptability will be key in shaping its future trajectory in the competitive IT landscape.