Centrica PLC: A Strategic Move in the Nuclear Sector

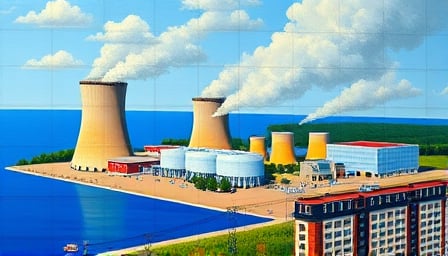

In a significant development for the energy sector, Centrica PLC, a leading integrated energy company based in the UK, is poised to take a 15% stake in the Sizewell C nuclear project. This move comes after years of delays and months of negotiations, with all parties eager to finalize the investment decision by July 2025. Centrica, known for its comprehensive energy solutions for both residential and business customers, is expanding its portfolio by investing in nuclear energy, aligning with global trends towards sustainable and reliable energy sources.

Financial Overview of Centrica PLC

As of June 24, 2025, Centrica’s shares closed at 166.25 GBP on the London Stock Exchange, with a 52-week high of 168.9 GBP and a low of 112.985 GBP. The company boasts a substantial market capitalization of approximately 810.55 billion GBP. With a price-to-earnings ratio of 6.57162, Centrica remains a significant player in the multi-utilities sector, reflecting its robust financial health and strategic market positioning.

Historical Investment Insights

Reflecting on past investment performance, Centrica’s stock has seen fluctuations over the years. For instance, on June 26, 2015, the stock was traded at 2.74 GBP. An investment of 10,000 GBP at that time would have experienced notable changes in value, highlighting the dynamic nature of the energy market and the importance of strategic investment decisions.

Market Dynamics and Global Developments

The broader financial landscape has seen positive trends, with the FTSE 100 experiencing a rise of 0.4%, partly driven by geopolitical developments and NATO’s increased defense spending target. These factors contribute to a favorable environment for energy companies like Centrica, which are integral to national and international energy security.

Leadership and Strategic Decisions

In related news, former Centrica chief Sam Laidlaw has expressed views on the need for restructuring within the UK oil sector, emphasizing the importance of strategic leadership in navigating industry challenges. This perspective underscores the ongoing transformations within the energy sector, where companies like Centrica are actively adapting to new market realities.

Conclusion

Centrica’s strategic investment in the Sizewell C nuclear project marks a pivotal moment in its growth trajectory, reinforcing its commitment to sustainable energy solutions. As the company navigates the evolving energy landscape, its financial stability and strategic initiatives position it well for future success in the multi-utilities sector.