CGRE AG’s Strategic Move: Sale of Retail Park in Leipzig

In a significant development within the real estate sector, CGRE AG, a publicly listed real estate platform operating across Germany, has announced the sale of a retail park in the Plagwitzer Höfe quarter in Leipzig to the REWE Group. This transaction, disclosed on May 20, 2025, marks a pivotal moment for CGRE AG as it navigates the complexities of the current market environment.

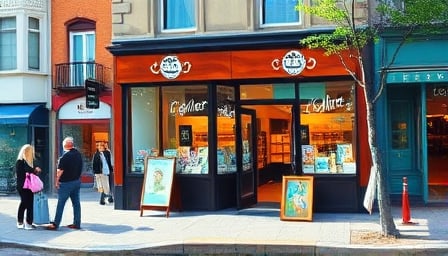

The Plagwitzer Höfe quarter, a vibrant area in Leipzig, has seen substantial development since 2007, with both new and existing buildings undergoing modernization and renovation. The retail park, which was part of this development, included a diverse commercial unit featuring a full-range retailer, discount retail stores, a beverage market, and a hardware store. This unit, now sold, represented approximately 20 percent of CGRE AG’s total rental space in the district.

The sale is not just a transaction but a strategic move by CGRE AG to bolster its financial standing. The purchase price from REWE Group will be allocated on a pro rata basis to repay project-related loan positions. This decision is aimed at enhancing liquidity in what is described as a highly dynamic investment environment. Such financial maneuvering is crucial for CGRE AG, especially considering its recent financial metrics, including a negative price-earnings ratio of -53.91 and a market capitalization of 86.4 million EUR.

Jürgen Kutz, an executive board member of CGRE AG, highlighted the significance of this sale, stating, “The successful sale in a difficult market environment underlines our focus towards the newly implemented business model.” This statement reflects the company’s adaptive strategies in response to market challenges and its commitment to a sustainable business model.

CGRE AG, headquartered in Leipzig and listed on the Frankfurt Stock Exchange, operates exclusively within Germany. The company, with a close price of 13.8 EUR as of May 15, 2025, has experienced fluctuations in its stock value, with a 52-week high of 123 EUR and a low of 3.8 EUR. Despite these challenges, the sale of the retail park in Leipzig is a testament to CGRE AG’s resilience and strategic foresight in the real estate sector.

As CGRE AG continues to navigate the complexities of the real estate market, this sale not only strengthens its financial position but also underscores its commitment to strategic growth and adaptation in a rapidly changing environment.