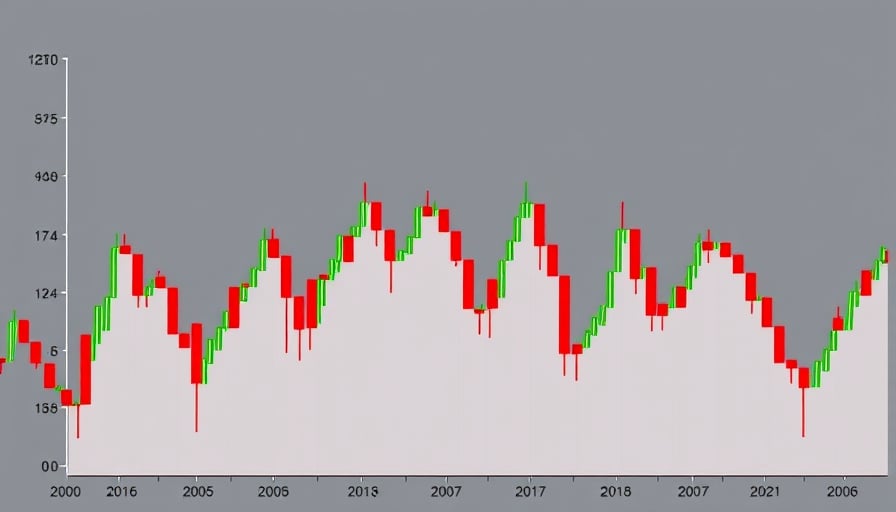

In the ever-evolving landscape of cryptocurrency, Chia has emerged as a noteworthy contender, albeit with a tumultuous journey marked by significant fluctuations in its valuation. As of January 3, 2026, Chia’s close price stood at $4.78297, a stark contrast to its 52-week high of $24.4734 recorded on January 14, 2025. This dramatic decline underscores the volatility inherent in the crypto market, raising questions about the sustainability and future prospects of Chia as a viable digital asset.

Chia’s market capitalization, currently valued at approximately $70,565,610.73, reflects its diminished stature in the crypto ecosystem. This valuation, while modest in comparison to the giants of the industry, still represents a significant pool of capital. However, the stark disparity between its 52-week high and low prices highlights the challenges Chia faces in maintaining investor confidence and market stability.

The cryptocurrency’s journey from its peak to its current position is emblematic of the broader challenges facing the crypto industry. Investors and enthusiasts alike are left to ponder the factors contributing to such volatility. Is it the result of market speculation, regulatory uncertainties, or perhaps the inherent risks associated with emerging technologies? These questions remain at the forefront of discussions surrounding Chia and its future trajectory.

Moreover, the decline in Chia’s valuation raises critical questions about its technological underpinnings and market differentiation. In a crowded marketplace, Chia’s unique approach to blockchain technology, which emphasizes energy efficiency and sustainability, was initially hailed as a revolutionary step forward. However, the recent downturn suggests that innovation alone may not suffice to secure a stable position in the competitive crypto landscape.

As Chia navigates these turbulent waters, the broader implications for the cryptocurrency market cannot be ignored. The volatility experienced by Chia serves as a cautionary tale for investors, highlighting the importance of due diligence and the need for a balanced approach to risk management. Furthermore, it underscores the ongoing debate about the role of cryptocurrencies in the global financial system and the regulatory frameworks necessary to ensure their stability and integrity.

In conclusion, Chia’s current predicament is a microcosm of the challenges facing the cryptocurrency industry at large. As it seeks to regain its footing, the path forward will require not only technological innovation but also strategic market positioning and regulatory compliance. The coming months will be critical in determining whether Chia can overcome its recent setbacks and reestablish itself as a significant player in the crypto space. For investors and enthusiasts alike, the unfolding story of Chia serves as a reminder of the dynamic and unpredictable nature of the cryptocurrency market.