China Yangtze Power Co Ltd: A Strategic Overview Amid Market Dynamics

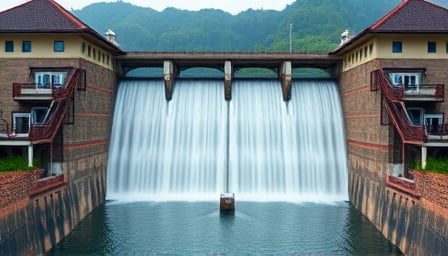

In the ever-evolving landscape of the global power sector, China Yangtze Power Co Ltd stands out as a pivotal player. As a utility company operating in the power generation sector, it has carved a niche for itself by generating a diverse array of power products, including electric and hydropower. Beyond its core operations, the company extends its expertise into investment, financing, and consulting services, catering to a global clientele. Since its public listing on the Shanghai Stock Exchange in November 2003, China Yangtze Power has demonstrated resilience and adaptability, navigating through market volatilities with strategic acumen.

Financial Highlights and Market Position

As of July 29, 2025, China Yangtze Power’s close price stood at 28.7 CNH, with a market capitalization of 708.11 billion CNH. The company’s price-to-earnings ratio of 20.973 reflects investor confidence in its growth prospects. Over the past year, the stock has seen fluctuations, with a 52-week high of 32.28 CNH and a low of 26.78 CNH, indicating a dynamic market response to both internal and external factors.

Recent Market Movements and Strategic Investments

The financial landscape for China Yangtze Power has been marked by significant movements and strategic decisions. Notably, the company has been the subject of a buy recommendation by China Galaxy Securities, highlighting its robust half-year performance in 2025. With a reported revenue of 365.87 billion CNH and a net profit of 129.84 billion CNH, the company has showcased a commendable growth trajectory, underpinned by a 14.22% increase in net profit compared to the previous year.

In a strategic move, China Yangtze Power has announced plans to invest approximately 266 billion CNH in the construction of the Gezhouba Shipping Capacity Expansion Project. This initiative not only underscores the company’s commitment to enhancing its operational capabilities but also reflects its strategic foresight in capitalizing on emerging opportunities within the power and shipping sectors.

Market Dynamics and Investment Flows

The broader market dynamics have seen a notable influx of investment into specific sectors, with the power sector experiencing a mixed flow of funds. While certain segments within the industry have witnessed capital inflows, others have faced outflows, highlighting the selective nature of investment strategies in the current economic climate. Amidst these fluctuations, China Yangtze Power has maintained a steady course, leveraging its strategic investments and operational efficiencies to navigate through the complexities of the market.

Looking Ahead

As China Yangtze Power Co Ltd continues to expand its footprint in the power generation sector, its strategic investments and operational excellence position it well for future growth. The company’s ability to adapt to market changes, coupled with its commitment to sustainable and innovative power solutions, sets a solid foundation for its continued success in the global energy landscape.

In conclusion, China Yangtze Power Co Ltd exemplifies resilience and strategic foresight in the face of market volatilities. With a robust financial performance and strategic investments in key projects, the company is well-poised to capitalize on future opportunities, reinforcing its position as a leader in the power generation sector.