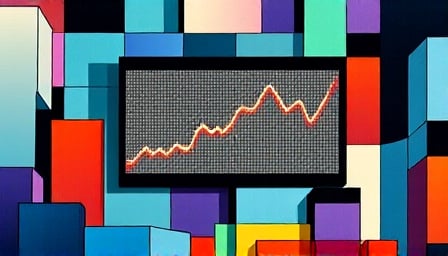

In the ever-evolving landscape of cryptocurrency, Classic USDC has emerged as a focal point of discussion, particularly in light of its recent performance metrics. As of September 13, 2025, Classic USDC closed at a price of 1.09944 USD, a figure that, while seemingly stable, belies the tumultuous journey it has undergone over the past year. This article delves into the critical aspects of Classic USDC’s performance, juxtaposing its current standing against its historical highs and lows, to provide a comprehensive analysis of its trajectory and implications for investors.

A Year of Volatility

The past year has been a rollercoaster for Classic USDC, with its value oscillating between a 52-week high of 1.18182 USD on January 26, 2025, and a staggering low of 0.522678 USD on February 9, 2025. This volatility is not merely a reflection of market dynamics but a testament to the inherent instability and speculative nature of the cryptocurrency market. The dramatic drop to its 52-week low underscores the susceptibility of digital currencies to rapid shifts in investor sentiment, regulatory news, and macroeconomic factors.

The Current Landscape

As of the latest data, Classic USDC’s close price of 1.09944 USD positions it closer to its 52-week high than its low, suggesting a recovery from its previous nadir. However, this recovery should not be misconstrued as a return to stability. The cryptocurrency market is notoriously unpredictable, and the current price of Classic USDC, while indicative of a rebound, does not guarantee future performance. Investors and market analysts alike must remain vigilant, recognizing that the factors contributing to past volatility remain at play.

Implications for Investors

The journey of Classic USDC over the past year serves as a cautionary tale for investors. The dramatic fluctuations in its value highlight the risks associated with investing in cryptocurrencies. While the potential for high returns exists, so too does the risk of significant losses. Investors must approach the cryptocurrency market with a critical eye, conducting thorough research and considering the broader economic and regulatory environment.

Looking Ahead

The future of Classic USDC, like that of many cryptocurrencies, remains uncertain. Its recent performance suggests a degree of resilience, yet the market’s inherent volatility means that its trajectory could change rapidly. Investors and market observers should monitor developments closely, paying particular attention to regulatory changes, technological advancements, and shifts in investor sentiment.

In conclusion, Classic USDC’s performance over the past year underscores the volatile nature of the cryptocurrency market. While its recent recovery is noteworthy, it is but a snapshot in a broader narrative of fluctuation and uncertainty. As the market continues to evolve, Classic USDC will undoubtedly remain a subject of interest, serving as a barometer for the health and direction of the cryptocurrency ecosystem at large.