Copper Giant Resources Corp, a prominent player in the metals and mining sector, has recently been the subject of market scrutiny due to its volatile share performance and financial metrics. Listed on the TSX Venture Exchange, the company operates within the broader materials sector, focusing on the acquisition, exploration, and mining of gold and other metal properties. As of February 12, 2026, the company’s shares closed at CAD 0.78, a slight decrease from its 52-week high of CAD 0.98 on February 5, 2026. This fluctuation underscores the inherent volatility in the mining industry, where market dynamics and commodity prices can significantly impact share values.

The company’s financial indicators present a mixed picture. With a market capitalization of CAD 165.3 million, Copper Giant Resources Corp has demonstrated resilience in maintaining its market presence despite challenging conditions. However, the price-to-earnings ratio stands at -4.22, reflecting negative earnings. This metric, coupled with a price-to-book ratio of 39.06, suggests that the market price is substantially above the book value, a scenario often indicative of investor optimism about future growth prospects or potential undervaluation of the company’s assets.

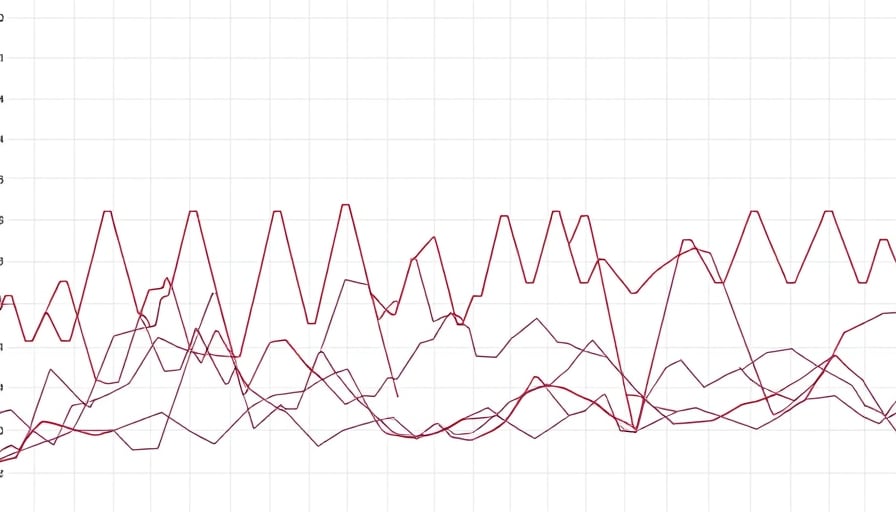

Over the past year, the share price has experienced considerable volatility, ranging from a low of CAD 0.145 on August 20, 2025, to its recent levels. This volatility can be attributed to various factors, including fluctuations in metal prices, operational challenges, and broader economic conditions affecting the mining sector. Despite these challenges, Copper Giant Resources Corp continues to pursue its mission of providing valuable services to customers in Canada through its mining operations.

The company’s recent public update, dated February 9, 2026, offered a concise overview of its market performance without delving into detailed commentary. This update serves as a reminder of the company’s ongoing efforts to navigate the complexities of the mining industry while striving to achieve its strategic objectives.

In summary, Copper Giant Resources Corp remains a key player in the metals and mining sector, characterized by its ambitious exploration and mining activities. While the company faces financial challenges, as evidenced by its negative earnings and high price-to-book ratio, its market capitalization and strategic focus on valuable metal properties position it for potential future growth. Investors and stakeholders will continue to monitor the company’s performance closely, particularly in light of the volatile nature of the mining industry and the broader economic landscape.