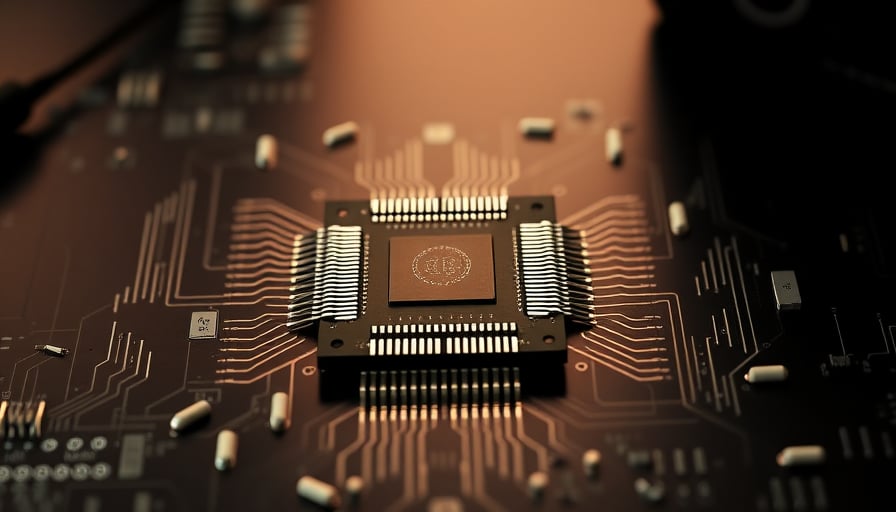

Credo Technology Group Holding Ltd, a prominent player in the information technology sector, has recently been the subject of considerable attention due to its strategic positioning and financial performance. As a holding company, Credo Technology Group operates through a network of subsidiaries that specialize in providing advanced connectivity solutions. These include IP and chiplets, line cards, optical DSPs, and active electrical cables, catering to a global customer base.

As of November 12, 2025, Credo Technology Group’s stock closed at $142.95 on the Nasdaq, reflecting a significant recovery from its 52-week low of $29.09 recorded on April 6, 2025. This recovery underscores the company’s resilience and the market’s confidence in its strategic direction. The 52-week high of $193.5, achieved on October 30, 2025, further highlights the potential investors see in Credo’s innovative solutions and market expansion efforts.

With a market capitalization of $27.74 billion, Credo Technology Group stands as a formidable entity within the IT sector. However, its price-to-earnings ratio of 209.22 suggests that investors are pricing in substantial future growth, reflecting optimism about the company’s ability to capitalize on emerging technologies and expand its market share.

Credo Technology Group’s offerings are pivotal in an era where connectivity and data transmission are critical to technological advancement. The company’s focus on IP and chiplets, along with its expertise in line cards and optical DSPs, positions it well to meet the increasing demand for high-performance connectivity solutions. These products are essential for a wide range of applications, from telecommunications to data centers, underscoring Credo’s role in the backbone of modern digital infrastructure.

The company’s global reach is a testament to its robust operational framework and strategic partnerships. By serving customers worldwide, Credo Technology Group not only diversifies its revenue streams but also mitigates risks associated with regional market fluctuations. This global presence is crucial for sustaining growth and maintaining competitive advantage in the fast-evolving IT landscape.

For stakeholders and potential investors, Credo Technology Group’s trajectory offers a compelling narrative of innovation, resilience, and strategic foresight. As the company continues to expand its product offerings and strengthen its market position, it remains a key player to watch in the information technology sector. Further insights into Credo’s operations and strategic initiatives can be found on their website at www.credosemi.com , providing a comprehensive overview of their mission and vision for the future.