In recent developments within the cryptocurrency market, a notable trend has emerged, suggesting a bullish outlook for a particular digital asset. This asset, identified by its close price of $0.0000693624 as of November 21, 2025, has been the subject of keen interest among investors and analysts alike. The fundamental data surrounding this cryptocurrency provides a compelling narrative of resilience and potential growth, underscored by its historical performance metrics.

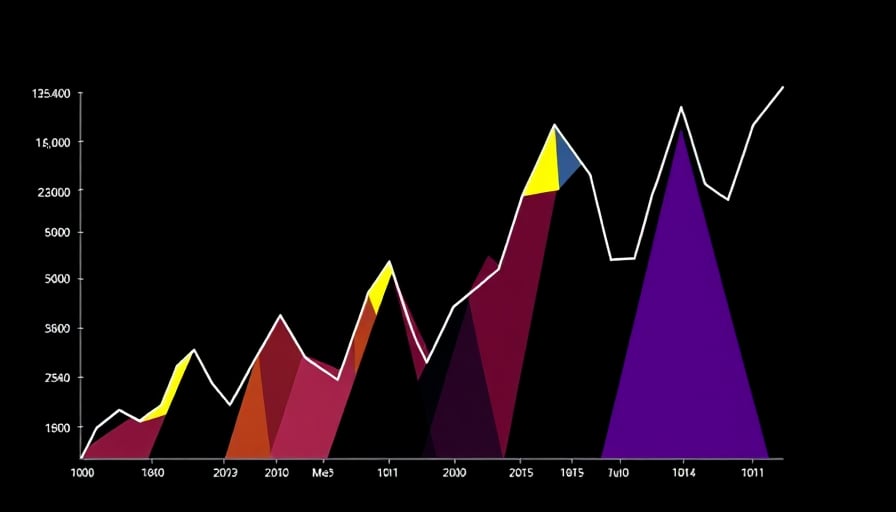

The asset’s journey over the past year has been marked by significant volatility, a characteristic trait of the cryptocurrency market. However, a closer examination of its price trajectory reveals a story of recovery and optimism. The 52-week high, recorded on November 30, 2024, at $0.000357488, stands as a testament to the asset’s potential for substantial appreciation. This peak represents a moment of peak investor confidence and market enthusiasm, setting a benchmark for future performance.

Conversely, the 52-week low, observed on April 8, 2025, at $0.000011815, highlights the asset’s vulnerability to market downturns and the inherent risks associated with cryptocurrency investments. This low point serves as a reminder of the challenges faced by digital currencies, including regulatory uncertainties, market sentiment shifts, and technological vulnerabilities.

Despite these challenges, the current close price suggests a positive momentum, indicating a recovery from the lows and a potential trajectory towards reclaiming its former highs. This bullish sentiment is not unfounded but is supported by a combination of factors, including technological advancements, increased adoption, and a growing recognition of cryptocurrencies as a viable asset class.

Investors and market observers are closely monitoring this asset, drawing on its historical performance as a guide for future expectations. The contrast between the 52-week high and low provides a framework for understanding the asset’s volatility and the opportunities it presents for strategic investment. The current price point, while significantly lower than the 52-week high, suggests a market that is cautiously optimistic, with potential for growth as the asset navigates the complexities of the cryptocurrency landscape.

In conclusion, the fundamental data surrounding this cryptocurrency paints a picture of an asset with a promising outlook. The interplay between its historical highs and lows, coupled with the current market dynamics, offers a narrative of resilience and potential. As the cryptocurrency market continues to evolve, this asset stands as a focal point for investors seeking to capitalize on the opportunities presented by digital currencies. The journey ahead is fraught with uncertainties, but the underlying bullish sentiment provides a beacon of hope for those willing to navigate the volatile waters of the cryptocurrency market.