Crypto Currency Crash: A Deep Dive into the Recent Turbulence

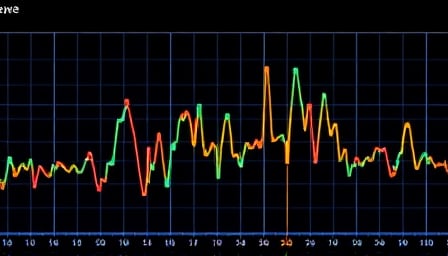

In the ever-evolving world of digital currencies, the recent crash has sent shockwaves through the market, leaving investors and enthusiasts alike scrambling to understand the implications. As of June 22, 2025, the close price of the affected cryptocurrency stood at a mere $0.00192557, a stark contrast to its 52-week high of $0.0401772 recorded on June 26, 2024. This dramatic decline highlights the volatility inherent in the crypto market, a characteristic that both attracts and deters investors.

The cryptocurrency in question has seen its value plummet to a 52-week low of $0.000859857 on March 9, 2025, underscoring the significant fluctuations that can occur within a short period. Despite these challenges, the market capitalization remains at $1,882,528.117, reflecting a resilient, albeit diminished, investor base.

Understanding the Volatility

The crypto market is known for its rapid price movements, driven by a variety of factors including regulatory news, technological advancements, and shifts in investor sentiment. The recent crash can be attributed to a combination of these elements, each playing a role in the dramatic price drop.

Regulatory uncertainty continues to loom large over the crypto space, with governments around the world grappling with how to integrate digital currencies into existing financial frameworks. This uncertainty can lead to sudden shifts in investor confidence, as seen in the recent downturn.

Technological issues, such as security breaches or network outages, can also have a profound impact on prices. Investors are quick to react to any news of vulnerabilities, often leading to rapid sell-offs.

Lastly, the sentiment of the market itself can be a self-fulfilling prophecy. As prices begin to fall, fear can spread among investors, prompting further sales and exacerbating the decline.

Looking Ahead

Despite the recent downturn, the crypto market continues to attract interest from a diverse range of investors. The potential for high returns, coupled with the allure of being part of a cutting-edge financial revolution, keeps many engaged.

For those looking to navigate the volatile waters of cryptocurrency, a balanced approach is key. Diversification, thorough research, and a clear understanding of one’s risk tolerance are essential strategies for weathering the storms that inevitably come with investing in digital currencies.

As the market continues to evolve, staying informed and adaptable will be crucial for anyone looking to capitalize on the opportunities that cryptocurrencies present. While the recent crash serves as a reminder of the risks involved, it also highlights the dynamic and ever-changing nature of the crypto world.