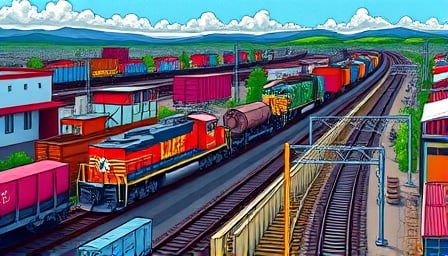

CSX Corp: A Year of Strategic Moves and Market Optimism

In the dynamic world of freight transportation, CSX Corporation has been making headlines with strategic developments and positive market sentiment. As a leading player in the industrials sector, particularly in ground transportation, CSX has been navigating through a landscape marked by potential mergers and upgrades from analysts.

A Look Back at Investment Growth

Reflecting on the past three years, investors in CSX have seen their portfolios grow. On July 21, 2022, CSX shares were valued at $30.99. Fast forward to July 21, 2025, and those shares have appreciated to $34.39. An investment of $1,000 back in 2022 would now be worth approximately $1,109.71, marking a 10.97% increase. This growth underscores CSX’s resilience and strategic positioning in the market, even as it navigates through fluctuating economic conditions.

Analyst Upgrades and Takeover Speculation

The recent upgrade of CSX by TD Cowen, alongside Norfolk Southern, has sparked discussions about potential takeover scenarios. Analysts are optimistic about the rising odds of a merger, which could reshape the landscape of the U.S. freight transportation industry. This speculation is fueled by the broader industry trend, as evidenced by Union Pacific’s exploration of a cross-continental merger with Norfolk Southern, aiming to create a $200 billion rail network.

Leadership and Market Confidence

Amidst these developments, CSX’s leadership has been receiving commendations. Jim Cramer, a well-known financial commentator, has praised the CEO’s performance, highlighting effective management and strategic foresight. This endorsement adds to the market’s confidence in CSX’s direction and leadership.

Market Dynamics and Challenges

Despite the positive outlook, CSX faces its share of challenges. The company’s stock has been navigating through neuralgic resistance zones, indicating potential volatility. Investors and analysts are closely watching these movements, as they could signal shifts in market sentiment or strategic adjustments by the company.

Conclusion

As CSX continues to evolve in the competitive freight transportation sector, its strategic initiatives, coupled with positive analyst sentiment, position it well for future growth. With potential mergers on the horizon and strong leadership at the helm, CSX is poised to capitalize on opportunities in the ever-changing industrial landscape. Investors and industry watchers alike will be keenly observing how these developments unfold in the coming months.