Cymat Technologies Ltd., a company headquartered in Mississauga, Canada, operates within the Materials sector, specifically focusing on the Metals & Mining industry. The company is publicly traded on the TSX Venture Exchange, with its financial activities denominated in Canadian Dollars (CAD). As of October 19, 2025, Cymat Technologies Ltd. reported a close price of 0.125 CAD per share. Over the past year, the company’s stock has experienced significant fluctuations, reaching a 52-week high of 0.23 CAD on July 7, 2025, and a 52-week low of 0.09 CAD on December 8, 2024.

Cymat Technologies Ltd. holds a market capitalization of 11,050,000 CAD. The company’s financial performance is reflected in its price-to-earnings (P/E) ratio, which stands at -2.15. This negative P/E ratio indicates that the company is currently not generating profits, which is a critical consideration for investors evaluating the company’s financial health and future prospects.

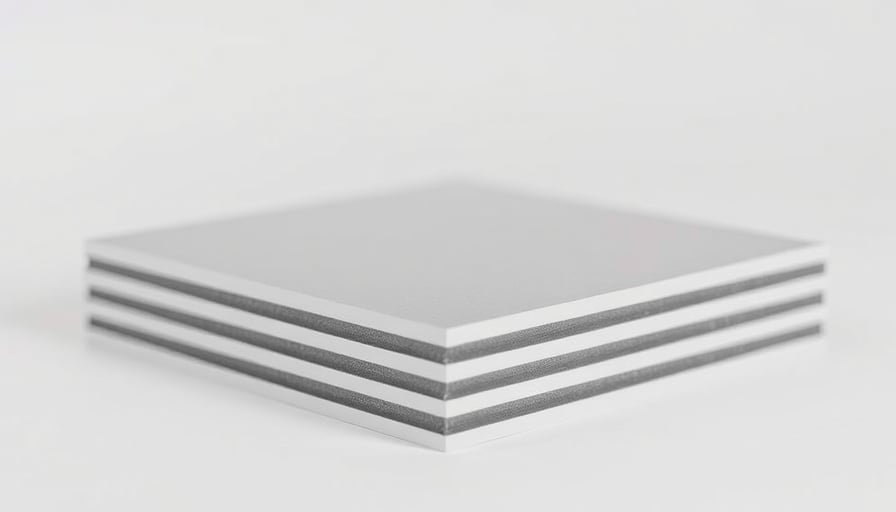

The core business of Cymat Technologies Ltd. revolves around its exclusive technology licenses, which enable the company to manufacture and distribute stabilized aluminum foam. This material is characterized by its lightweight, porous, and isotropic properties, making it a unique product in the market. The aluminum foam is primarily composed of scrap aluminum and aluminum alloys, aligning with sustainable practices by utilizing recycled materials.

Cymat Technologies Ltd.’s innovative approach to producing stabilized aluminum foam positions it as a key player in the development of advanced materials. The company’s focus on leveraging scrap aluminum not only supports environmental sustainability but also offers potential cost advantages in the production process. As the demand for lightweight and durable materials continues to grow across various industries, Cymat Technologies Ltd. is strategically positioned to capitalize on these market trends.

In summary, Cymat Technologies Ltd. is a company with a distinctive focus on producing stabilized aluminum foam, a material with significant potential applications due to its unique properties. Despite its current lack of profitability, as indicated by its negative P/E ratio, the company’s innovative technology and sustainable practices may offer promising opportunities for future growth and development within the Metals & Mining sector.