CYNGN Inc., a software solution provider based in Menlo Park, United States, operates within the Information Technology sector, focusing on autonomous driving software for commercial and industrial machines. The company serves a primarily American customer base and is listed on the Nasdaq exchange. As of October 28, 2025, CYNGN Inc.’s stock closed at $4.66, reflecting a significant fluctuation over the past year, with a 52-week high of $1312.5 on November 12, 2024, and a 52-week low of $3.62 on March 11, 2025. The company’s market capitalization stands at $33,300,000 USD.

Despite its innovative focus, CYNGN Inc. currently reports a negative price-to-earnings ratio of -0.16, indicating that the company is not yet profitable. This financial metric underscores the challenges faced by many technology firms in achieving profitability while investing heavily in research and development.

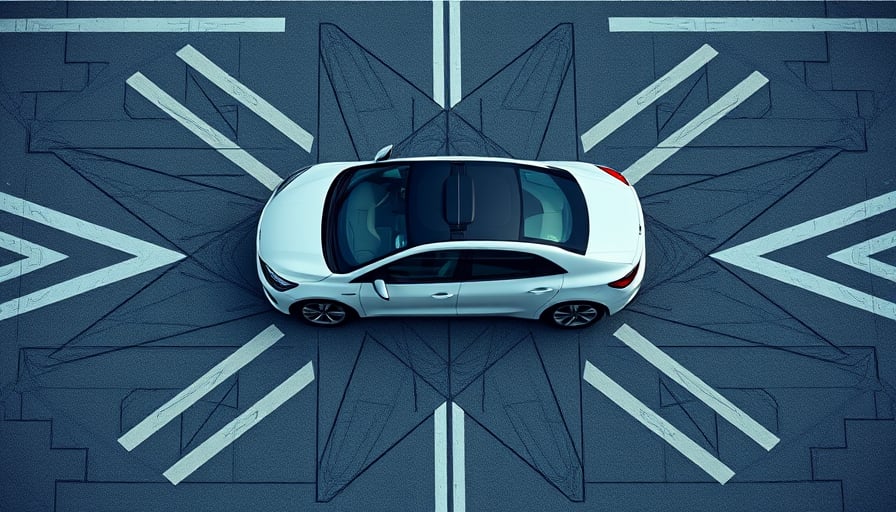

CYNGN Inc.’s core business revolves around developing autonomous driving software, a critical component in the advancement of autonomous vehicles and machinery. This technology is increasingly vital as industries seek to enhance efficiency, safety, and operational capabilities through automation. The company’s strategic focus on commercial and industrial applications positions it to capitalize on the growing demand for autonomous solutions in sectors such as logistics, agriculture, and manufacturing.

For stakeholders and potential investors, CYNGN Inc. offers detailed information about its offerings and initiatives on its official website, www.cyngn.com . The company’s commitment to innovation in autonomous driving technology continues to drive its strategic initiatives, aiming to establish itself as a leader in this transformative field.

As CYNGN Inc. navigates the competitive landscape of the Information Technology sector, its ability to deliver cutting-edge solutions and achieve financial stability will be crucial in determining its long-term success and growth potential.