Cytokinetics Inc. Makes Strategic Moves Amid Positive Developments

In a series of recent announcements, Cytokinetics Inc., a clinical-stage biopharmaceutical company, has been making strategic moves that are capturing the attention of investors and industry watchers alike. Based in South San Francisco, Cytokinetics specializes in developing novel small molecule therapeutics aimed at modulating muscle function, with a focus on treating various diseases and medical conditions.

Inducement Grants to Attract Talent

On May 16, 2025, Cytokinetics announced the granting of inducement grants under Nasdaq Listing Rule 5635(c)(4). The company awarded stock options for 40,275 shares of common stock and 27,144 restricted stock units (RSUs) to five new employees who joined in April and May 2025. This move is designed to attract and retain top talent by providing a material inducement for their employment. The RSUs are set to vest over three years, with 40% vesting on the first anniversary of their employment.

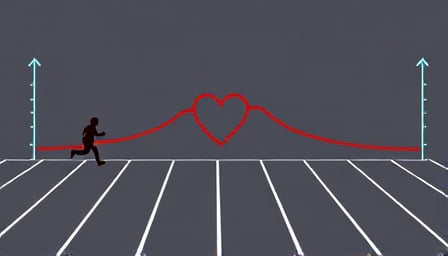

Positive Phase 3 Results for Aficamten

Earlier in the week, on May 15, Cytokinetics shared positive phase 3 results for aficamten, a drug aimed at treating heart disease. This development is significant as it highlights the company’s progress in its pipeline and its potential impact on the healthcare sector. Aficamten’s success in phase 3 trials could pave the way for regulatory approval and commercialization, offering new treatment options for patients with heart disease.

Upcoming Symposium on Muscle Biology

Cytokinetics is also set to host a symposium on the contemporary landscapes in muscle biology. Scheduled for May 15, 2025, this event aims to bring together experts and stakeholders in the field to discuss the latest advancements and challenges in muscle biology research. The symposium underscores Cytokinetics’ commitment to fostering collaboration and innovation in its area of expertise.

Analyst Confidence in Cytokinetics’ Future

Adding to the positive momentum, Needham reiterated a Buy rating on Cytokinetics with a $72 price target on May 14, 2025. This endorsement from a reputable analyst firm reflects confidence in the company’s strategic direction and potential for growth. With a current close price of $30 as of May 13, 2025, and a 52-week low of $29.925, the market cap stands at $5.12 billion. Despite a negative price-to-earnings ratio of -8.13, the company’s recent developments and strategic initiatives suggest a promising outlook.

As Cytokinetics continues to navigate the biotechnology landscape, its focus on innovative therapeutics and strategic talent acquisition positions it well for future success. Investors and industry observers will be keenly watching the company’s progress, particularly in light of its recent achievements and strategic initiatives.