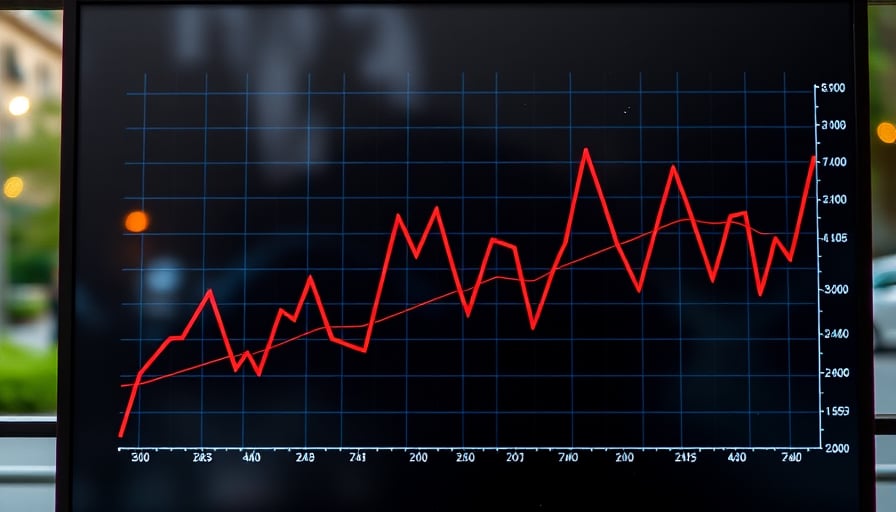

Delek Group Ltd., an independent exploration and production company operating within the energy sector, has recently disclosed its quarterly results for the fiscal period ending August 22, 2025. The company, which is listed on the Tel Aviv Stock Exchange, has demonstrated a consistent performance in the volatile oil, gas, and consumable fuels industry. As of January 22, 2026, Delek Group’s stock closed at 83,550 ILS, reflecting a position that is strategically balanced between its 52-week low of 51,260 ILS, recorded on January 27, 2025, and its peak of 98,000 ILS, achieved on November 18, 2025.

The company’s market capitalization stands at approximately 4.87 billion ILS, underscoring its significant presence in the energy sector. Delek Group’s operations are diverse, encompassing the retail of gasoline and lubricants through a network of convenience stores, as well as the management of a crude oil pipeline and refinery in the United States. Additionally, the company holds substantial stakes in Israeli natural gas fields, further solidifying its role as a key player in the regional energy landscape.

Financially, Delek Group maintains a modest valuation with a price-to-earnings ratio of 11.39, indicating that its shares are trading at a reasonable premium relative to its earnings. The price-to-book ratio of 1.42 suggests a slight premium to book value, which is indicative of stable profitability and a conservative balance sheet. These metrics reflect the company’s prudent financial management and its ability to navigate the complexities of the energy market.

Delek Group’s strategic investments and operational efficiencies have positioned it well within the competitive landscape of the energy sector. The company’s focus on both upstream and downstream activities, coupled with its significant presence in the Israeli natural gas market, provides a diversified revenue stream that mitigates risks associated with market fluctuations.

As Delek Group continues to expand its operations and explore new opportunities, its commitment to sustainable and efficient energy production remains a cornerstone of its business strategy. The company’s forward-looking approach, combined with its robust financial health, positions it well for continued growth and success in the evolving energy landscape.

For further insights into Delek Group’s operations and strategic initiatives, stakeholders are encouraged to visit their official website at www.delekdrilling.com .