Denny’s Corp Overview

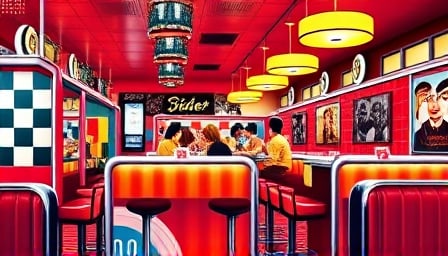

Denny’s Corporation, a prominent player in the Consumer Discretionary sector, operates as the largest franchised full-service restaurant chain under the Denny’s brand. Known for its diverse menu offerings, the company provides a wide range of lunch and dinner items, including burgers, sandwiches, salads, entrees, beverages, appetizers, and desserts. Denny’s manages both franchised and licensed restaurants globally, maintaining a strong presence in the Hotels, Restaurants & Leisure industry.

Financial Snapshot

As of August 24, 2025, Denny’s Corp’s stock closed at $4.50 on the Nasdaq exchange. The company’s market capitalization stands at $217,840,000 USD. Over the past year, the stock has experienced significant volatility, reaching a 52-week high of $7.73 on November 5, 2024, and a 52-week low of $2.85 on April 8, 2025. The price-to-earnings ratio is currently 13.771, reflecting investor sentiment and market conditions.

Company Background

Denny’s Corporation was established as a public company with its initial public offering on November 22, 1989. Since then, it has grown to become a leading name in the full-service restaurant industry. The company’s website, www.dennys.com , serves as a portal for customers to explore its offerings and for investors to access corporate information.

Global Operations

With a global footprint, Denny’s operates a network of franchised and licensed restaurants, ensuring a consistent dining experience across various locations. This extensive reach underscores the company’s commitment to maintaining its brand’s reputation and expanding its market presence worldwide.

Conclusion

Denny’s Corporation continues to be a significant entity in the restaurant industry, leveraging its extensive franchise network and diverse menu offerings to cater to a broad customer base. Despite recent stock fluctuations, the company remains a key player in the Consumer Discretionary sector, with a focus on growth and sustainability in the competitive landscape of Hotels, Restaurants & Leisure.