DENTSPLY SIRONA Inc. Reports Strong Q1 Performance, Surpasses Analyst Expectations

In a notable development for the health care equipment and supplies sector, DENTSPLY SIRONA Inc. has reported a robust first-quarter performance for 2025, surpassing Wall Street’s expectations. The company, a leader in dental solutions, announced earnings of $20 million, or $0.10 per share, marking an increase from the previous year’s $18 million, or $0.09 per share. This performance has been well-received by investors, reflecting positively on the company’s strategic initiatives and market positioning.

Despite a 7.7% decrease in net sales to $879 million, the company’s organic sales saw a more modest decline of 4.4%, with a 4.0% impact attributed to Byte sales. The adjusted gross margin stood at 56.3%, with an adjusted EBITDA margin of 19.0%, showcasing DENTSPLY SIRONA’s ability to maintain profitability amidst challenging market conditions.

The company’s stock, listed on the Nasdaq, closed at $13.37 on May 5, 2025, reflecting a recovery from its 52-week low of $12.16 on April 10, 2025. While still below its 52-week high of $28.69, the recent earnings report has injected optimism into the market, suggesting potential for further gains.

Market Reaction and Future Outlook

The market’s response to DENTSPLY SIRONA’s Q1 earnings has been overwhelmingly positive, with analysts highlighting the company’s resilience and strategic focus as key drivers of its performance. The earnings beat has not only bolstered investor confidence but also positioned DENTSPLY SIRONA as a strong contender in the health care equipment and supplies industry.

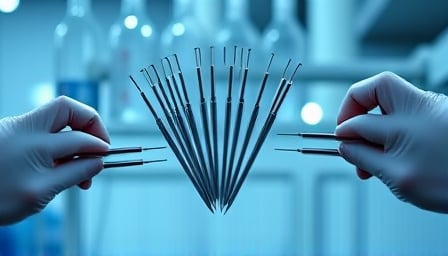

Looking ahead, DENTSPLY SIRONA is expected to continue leveraging its global presence and diversified product portfolio to drive growth. The company’s focus on innovation, particularly in endodontics, implantology, and digital dental solutions, is anticipated to play a crucial role in its future success.

Reflection on Past Performance

In a retrospective analysis, it’s noteworthy that an investment in DENTSPLY SIRONA a decade ago would have seen significant fluctuations. The stock, which was trading at $50.75 ten years prior, has experienced a journey marked by both highs and lows. This historical perspective underscores the volatile nature of the stock market and highlights the importance of strategic investment decisions.

Conclusion

DENTSPLY SIRONA Inc.’s Q1 earnings report for 2025 has set a positive tone for the company’s future, demonstrating its ability to navigate market challenges and capitalize on growth opportunities. With a strong focus on innovation and strategic market positioning, DENTSPLY SIRONA is well-placed to continue its trajectory of growth in the competitive health care equipment and supplies sector. Investors and industry observers alike will be keenly watching the company’s next moves, anticipating further developments in its journey towards sustained success.