Deutz AG Sees Market Momentum Backed by Industry Outlook and Investor Confidence

Deutz AG, the German diesel‑engine specialist headquartered in Köln, has experienced a notable uptick in its share price, inching toward the most recent annual high. The rally is not driven by a single company‑specific announcement but rather by a confluence of positive signals from the broader industrial machinery sector, improved investor sentiment, and a forthcoming product showcase that underscores the company’s shift toward greener propulsion technologies.

Sector‑Wide Support from Deere & Co.

On Thursday, U.S. manufacturer Deere & Co. reported a 13 % rise in first‑quarter sales, reaching $9.61 billion. More consequential was the firm’s upward revision of its 2026 net‑profit outlook to $4.5‑$5.0 billion (up from $4.0‑$4.75 billion) and a doubling of operating earnings in its Construction & Forestry segment to $137 million. Market participants interpreted these figures as evidence that demand for heavy machinery is more robust than previously feared. In a market tightly linked to the health of large‑equipment suppliers, such a positive outlook naturally lifts the profile of firms like Deutz that manufacture the engines powering these machines.

The impact on Deutz’s share price was immediate. At market close on Friday, 21 February, the stock traded at €11.57, a 1.7 % gain. Intraday trading pushed the price as high as €11.65, falling only a few cents short of the 52‑week high of €11.67 reached earlier that week. The close of the U.S. quarter‑finals report acted as a catalyst, reinforcing the narrative that the sector’s momentum will benefit Deutz’s core engine business.

Anticipated Product Launch at CONEXPO 2026

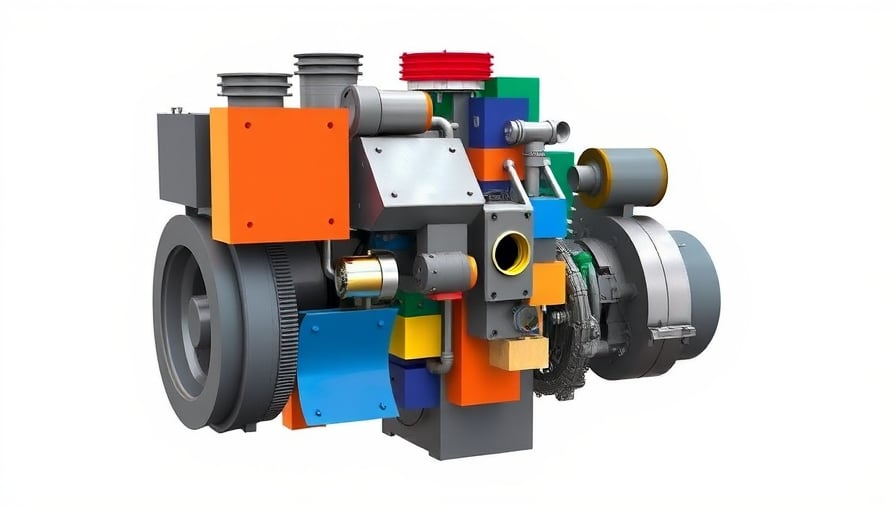

A second driver of investor optimism stems from Deutz’s upcoming participation in CONEXPO in Las Vegas (3–7 March). The company plans to unveil new system solutions for sustainable mobility in off‑highway applications, including hydrogen‑based internal combustion engines and electric drive systems. This event is positioned as a tangible showcase of Deutz’s strategic pivot from traditional diesel engines toward green propulsion technologies.

The timing of the launch aligns with a broader industry push toward decarbonisation. Deutz’s emphasis on hydrogen and electric solutions, particularly for construction and mining sectors, signals its intent to capture emerging markets that are increasingly looking for low‑emission alternatives. By presenting these innovations on a prominent international stage, Deutz aims to reinforce its reputation as an engine‑manufacturing pioneer ready to adapt to future regulatory and consumer demands.

Strengthening Investor Position and Management Confidence

Investor sentiment has been further buoyed by two key institutional moves. Gold‑Meyer, a prominent investment bank, announced a substantial increase in its voting rights in Deutz, raising its stake to roughly 4.09 % in February. This move, coupled with a significant insider purchase by board member Oliver Neu (reported 9 February), signals institutional conviction in the company’s prospects.

Simultaneously, Deutz’s Chief Executive Officer, Sebastian C. Schulte, reinforced management confidence by personally investing approximately €110 000 in company shares at the beginning of the week. Such “directors’ deals” are widely regarded as a strong indicator of internal faith in the firm’s operational trajectory.

The confluence of institutional support and executive investment occurs during a pivotal transformation phase, where Deutz is actively re‑positioning itself within the evolving landscape of industrial mobility. These capital movements provide the market with tangible evidence of faith in the company’s strategic direction and financial health.

Market Context and Outlook

With a market capitalization of approximately €1.76 billion and a price‑to‑earnings ratio of 42.41, Deutz’s valuation reflects both its established legacy and the premium associated with its transition to greener technologies. The company’s recent performance, driven by positive sector signals, robust investor confidence, and an upcoming product showcase, suggests a cautiously optimistic outlook.

Deutz’s close to a 52‑week high, coupled with the momentum from Deere & Co.’s earnings and the imminent CONEXPO presentation, positions the company favorably within the industrial machinery sector. Investors will likely continue to watch for further confirmation of the company’s strategic shift, including any subsequent revenue growth from its new hydrogen and electric engine lines.

In summary, Deutz AG’s current share price rally is a composite of broader industry optimism, proactive product development, and strong institutional endorsement. These factors collectively create a narrative that the company is not only maintaining its traditional strengths but also carving a forward‑looking path in a rapidly changing market.