Dongfang Electric Corp Ltd: Market Movements and Industry Trends

Market Overview

On July 23, 2025, Dongfang Electric Corp Ltd, a prominent player in the electrical equipment industry, experienced significant market activity. The company’s stock, traded on the Shanghai Stock Exchange, closed at 21.58 HKD, matching its 52-week high. The market capitalization stood at 570.7 billion HKD, with a price-to-earnings ratio of 17.02.

Industry Trends

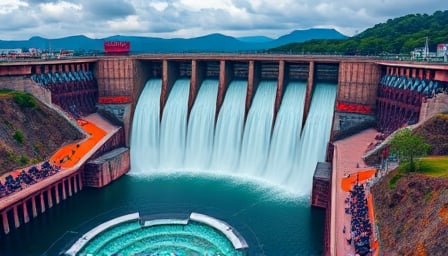

The hydro and steam power generators and AC/DC electric motors sector, where Dongfang Electric operates, has seen heightened interest. This surge is part of a broader trend in the water turbine concept, which has gained traction following the launch of the Yarlung Tsangpo River hydropower project. The project, valued at 1.2 trillion yuan, includes the construction of five tiered power stations and has sparked a wave of investment in related stocks.

Stock Performance

Dongfang Electric, along with other industry leaders like Guomai Heavy Industries and Zhefu Holdings, saw its stock price soar, reaching a 12-day high. The company’s stock was part of a broader trend where 1269 A-shares rose, accounting for 23.48% of the market, while 4027 shares fell.

Investment Insights

Investment advisory firms have highlighted the global water turbine market’s robust performance, with sales reaching $3.614 billion in 2023. The market is expected to maintain a steady growth trajectory in the coming years, further boosting companies like Dongfang Electric.

Market Dynamics

Despite the positive trends in specific sectors, the broader market faced challenges. Mainland funds continued to flow out for the fourth consecutive day, with a net outflow of 515.28 billion yuan. This trend affected various sectors, including the Shenzhen and ChiNext boards.

Risk Warnings

Investors are advised to consider the risks associated with stock trading. Dongfang Electric issued a risk warning, emphasizing the need for caution in volatile markets.

Conclusion

Dongfang Electric Corp Ltd remains a key player in the electrical equipment industry, benefiting from the growing interest in hydroelectric projects. While the company faces market volatility, its strategic position in the water turbine sector positions it well for future growth. Investors should stay informed about industry trends and market dynamics to make informed decisions.