Dongguan Dingtong Precision Metal Co Ltd: A Surge in Market Activity

On August 28, 2025, Dongguan Dingtong Precision Metal Co Ltd, a company listed on the Shanghai Stock Exchange, experienced significant market activity. The company’s stock price closed at 106.13 CNY on August 26, 2025, with a 52-week high of 125.09 CNY on August 17, 2025, and a low of 31.3 CNY on September 17, 2024. The market capitalization stood at 14,773,475,614 CNY, with a price-to-earnings ratio of 78.40002.

Market Dynamics and Sector Performance

The A-share market saw a rebound, with technology stocks leading the charge. The ChiNext 50 index surged over 7% in the afternoon, reaching a new three-and-a-half-year high of 1300 points. The ChiNext board index also rose nearly 4%, surpassing 2800 points, marking a new three-year high. The Shanghai Composite Index and Shenzhen Component Index also strengthened in the afternoon, with trading volumes exceeding 3 trillion CNY.

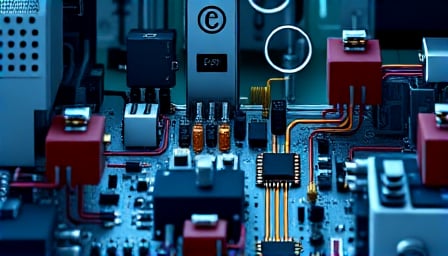

Key sectors such as telecommunications equipment, semiconductors, new energy vehicles, and aerospace equipment saw significant gains. Conversely, agriculture, forestry, fisheries, coal, assisted reproduction, and entertainment products experienced declines.

Capital Flows and Sector Insights

The electronics industry attracted over 310 billion CNY in net capital inflows, with telecommunications and computing sectors also seeing substantial inflows of over 135 billion CNY and 79 billion CNY, respectively. The non-ferrous metals sector received over 59 billion CNY, while non-banking financials, power equipment, defense, and basic chemicals sectors also saw inflows exceeding 20 billion CNY. In contrast, the biopharmaceutical sector faced a net outflow of over 50 billion CNY, with food and beverage, and utilities sectors also experiencing significant outflows.

Dongguan Dingtong Precision Metal Co Ltd’s Performance

Dongguan Dingtong Precision Metal Co Ltd, also known as Dingtong Technology, saw a significant influx of large-scale capital on August 28, 2025. The company’s stock surged by 20%, with a net inflow of 1.70 billion CNY, indicating strong buying interest. This surge was part of a broader trend in the semiconductor industry, which continued to show strong performance.

Market Outlook and Analysis

According to Zhongjin Company, while capital inflows are not linear, there is a need to be cautious of concentrated inflows and overheated sentiment that could increase volatility. However, the Shanghai Composite Index’s trailing twelve-month price-to-earnings ratio of 13.9 times and the Hang Seng Index’s 11.5 times are significantly discounted compared to U.S. stocks, suggesting potential for asset revaluation. From an international investor’s perspective, the domestic stock market is far from being overvalued, and the underlying logic remains unchanged, indicating that even if there is a correction, it could present buying opportunities.

Conclusion

Dongguan Dingtong Precision Metal Co Ltd’s recent performance reflects broader market trends and sector dynamics. With significant capital inflows and strong sector performance, the company is well-positioned in the current market environment. Investors should remain vigilant of potential volatility while considering the long-term growth prospects in the semiconductor and related industries.